Collect taxes

Customers in the United States, the European Union, the United Kingdom, Canada, or Australia can collect taxes on new subscriptions through their checkout.

If your account is in test mode, we'll use the minimum summary rate for a given state / province / country. For the U.S. and Canada, each billing address from the same state / province will have the same tax rate. For Australia, the EU, and the UK, billing addresses from the same country will have the same tax rate.

In this article, we’ll walk through enabling tax collection, setting nexus locations, tax-inclusive vs. tax-exclusive pricing, how tax data appears in receipts, how to export your tax records from Stripe, and more!

In this help doc:

- Enable tax collection.

- Input locations where your business has economic nexus.

- Tax excluded vs. Tax included.

- Enable taxes for specific plans.

- Charge the VAT rate of your home country (EU only).

- Charge provincial taxes with a Canadian Nexus address (Canada only)

- Review the member checkout flow.

- Learn about the reverse charge mechanism.

- How to handle existing subscription renewals.

- Review what's included in our order receipts / invoices.

- Review the information passed to Stripe.

Enable tax collection

Memberful does not file or remit taxes on your behalf to the government; we simply help you collect the appropriate taxes at the time of the transaction. You’ll still need to remit taxes on your own. We pass information to your Stripe account to make that easier.

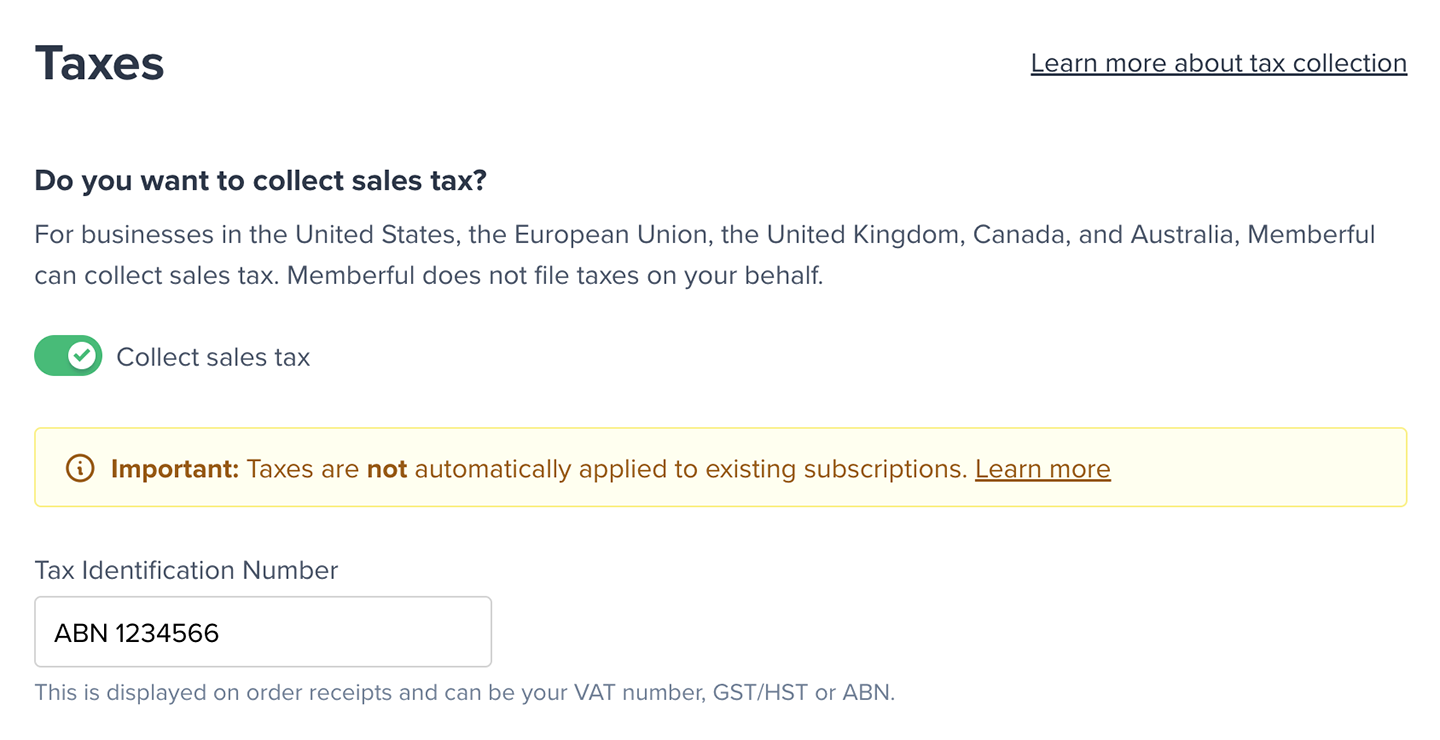

By default, taxes are not collected when members go through your checkout. To enable tax collection, navigate to Settings → Taxes in your Memberful dashboard and enable the Collect sales tax option.

If your business is located in the European Union, Canada, or Australia you will also be asked to provide your tax identification number (VAT, GST, etc). When taxes are charged to your members, this number will be added to the payment receipts sent to them for bookkeeping purposes and compliance.

If you aren’t sure if you need to collect taxes or have additional questions, we recommend speaking with a licensed tax professional since requirements may differ depending on the location of your business.

Input locations where your business has economic nexus

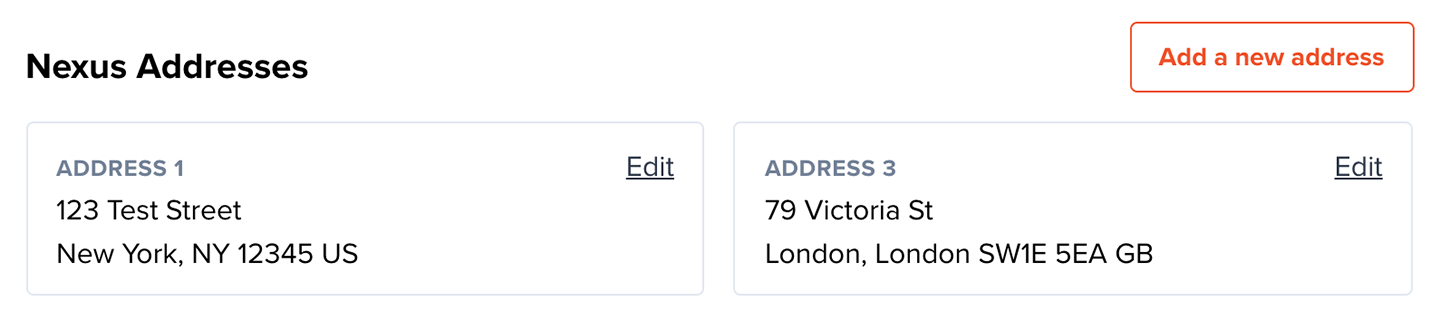

Once you enable this setting you’ll need to input the location(s) where your business has economic nexus. These locations are compared against where your members are located so that Memberful can calculate the appropriate taxes (if any) that should be applied to their order.

Tax excluded vs. Tax included

By default, all your prices are tax excluded. If we determine that a member should pay taxes on a given order, we'll add the taxes on top of the subtotal.

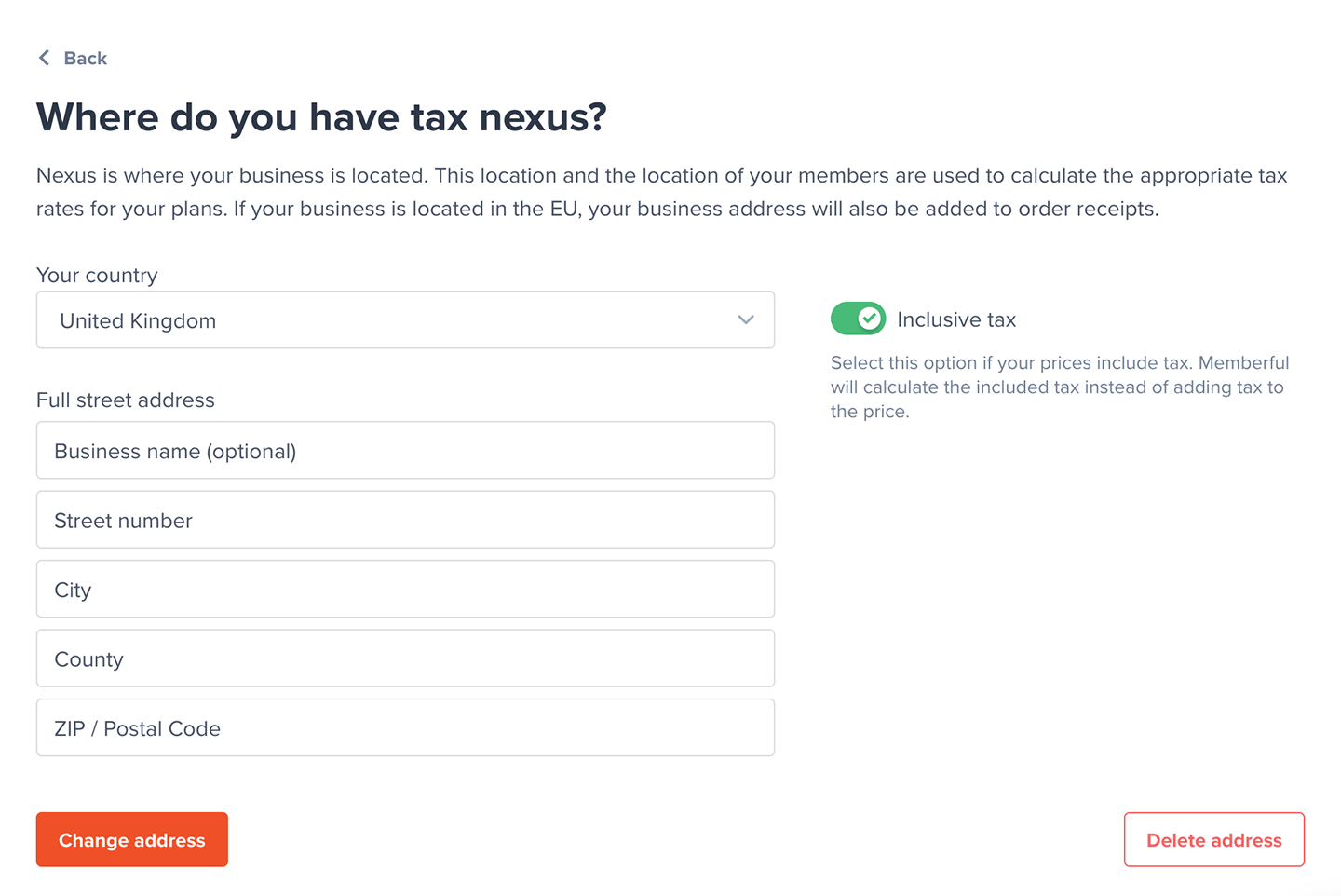

If you prefer to have taxes included in your price, you can do so on a per-nexus basis. For example, if you want to include taxes only for your European members, go to your European Nexus Address (Settings → Taxes), edit a Nexus Address, and enable the Inclusive tax option.

Keep in mind that if you lowered your plan prices to account for taxes not being included, you'll need to revert your price back to "normal" after enabling tax-inclusive pricing.

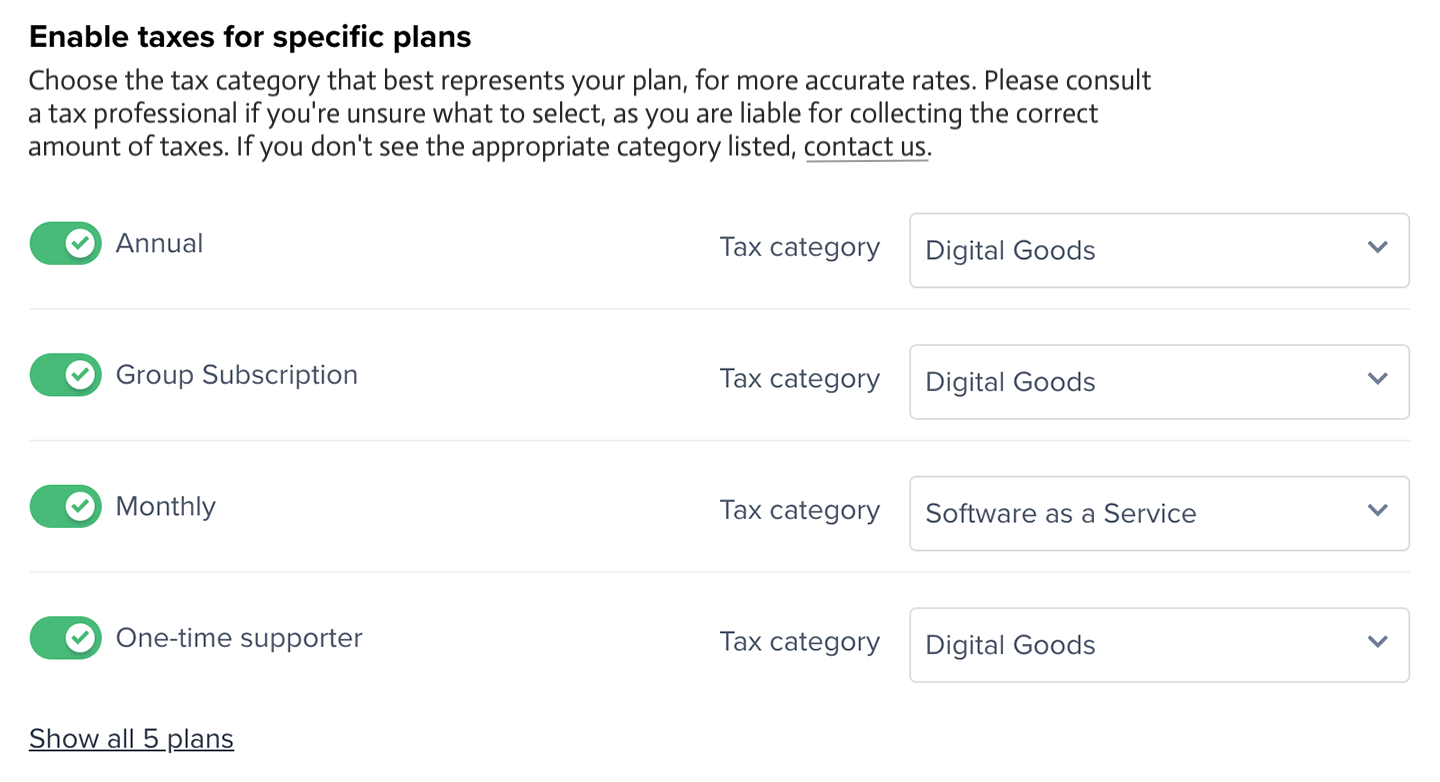

Enable taxes for specific plans

You can enable taxes on a per-plan basis and select a corresponding tax category. We default to Digital Goods. Choose the tax category that best represents your plan for more accurate rates. Please consult a tax professional if you're unsure what to select, as you are liable for collecting the correct amount of taxes.

If taxes are enabled globally for your account, we default to taxes being enabled whenever you create a new plan or standalone download. For plans, you can disable (or enable) tax collection via Settings → Taxes or from the individual plan settings page. For downloads, you can disable (or enable) tax collection from each download page.

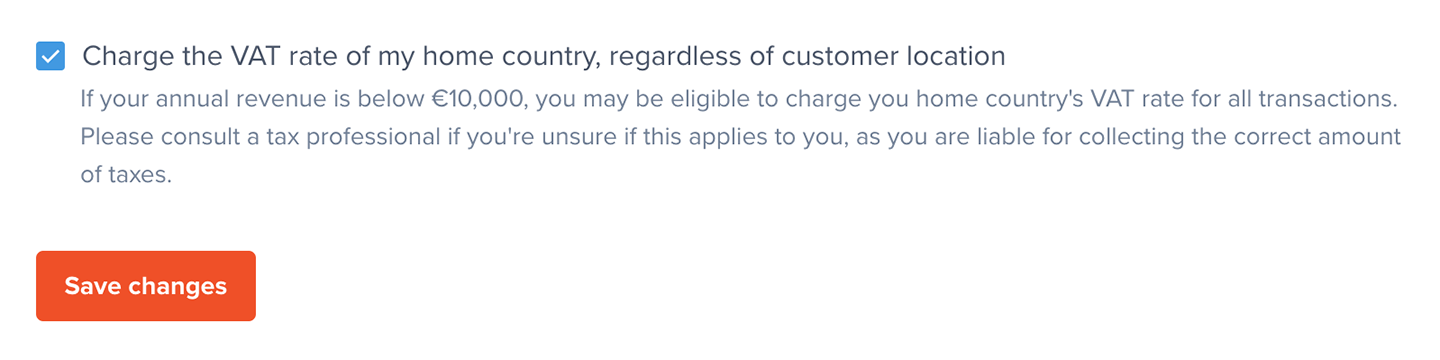

Charge the VAT rate of your home country (EU only)

If your annual revenue is below €10,000, you may be eligible to charge your home country's VAT rate for all transactions. Please consult a tax professional if you're unsure if this applies to you, as you are liable for collecting the correct amount of taxes.

Sales of B2B (business to business, which are sales to people or entities who are themselves VAT registered) do not count towards the threshold. Sales of B2C (business to consumer) do count towards the threshold.

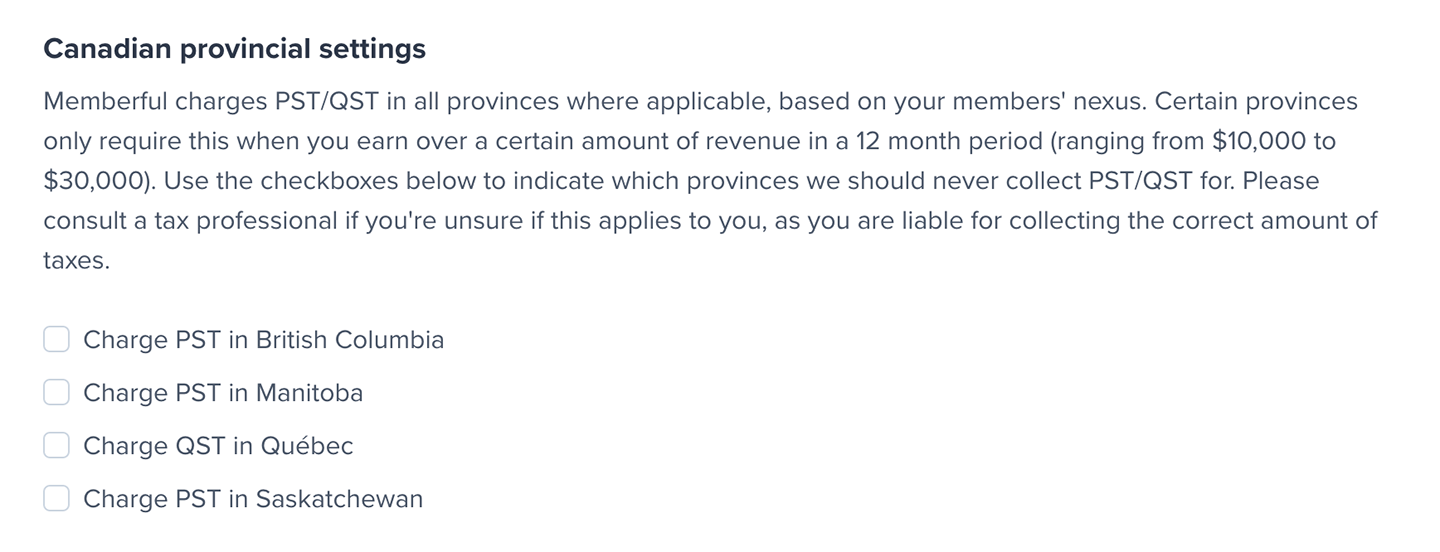

Charge provincial taxes with a Canadian Nexus address (Canada only)

Several provinces in Canada have updated their tax laws to require registration and tax collection when a company has more than a certain amount of revenue in the span of 12 months. These thresholds are different for each province, as are the local tax rates.

Once the threshold is crossed, they require businesses to collect Provincial Sales Tax/PST (or Quebec Sales Tax/QST in Quebec) in addition to the country-wide 5% Goods and Services Tax (GST) rate. When a company is below the threshold, they only charge the 5% GST.

The four provinces where this applies, are:

- British Columbia (BC)

- Manitoba (MB)

- Quebec (QC)

- Saskatchewan (SK)

If you entered a Canadian Nexus address, you will now have the options to collect taxes for members from those provinces.

If selected, when a member goes through checkout, we'll check their nexus to see if it is in one of these four provinces. If it is, we will charge the GST Canadian rate, and the province's PST/QST rate.

Member checkout flow

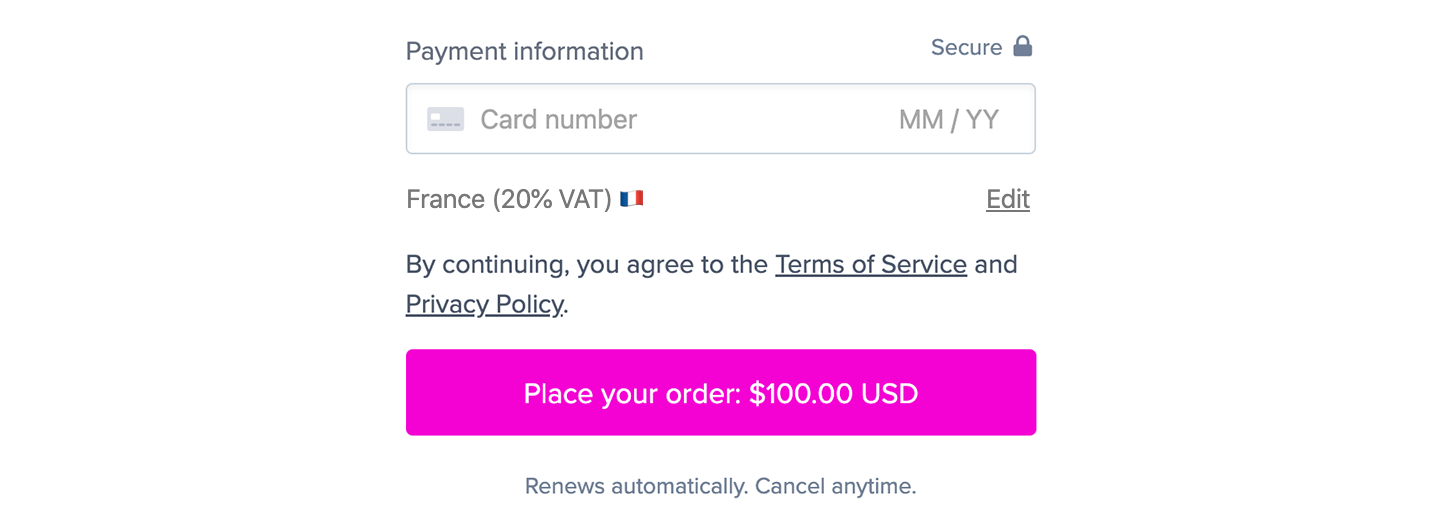

Once you have taxes enabled and a member enters your checkout flow, we determine their location to calculate which taxes need to be applied (if any). The information we collect varies based on where you have economic nexus. For example, in the European Union, we verify two non-conflicting pieces of location evidence to ensure your business' legal compliance when it comes to remitting taxes.

We always strive to provide a high-converting checkout flow and therefore we do our best to calculate the appropriate tax rate with little or no extra action required from your members.

When members enter the checkout flow we detect which country they’re currently located in using their IP address. Depending on where your business is located, in the EU for example, that may be enough information to make an initial assumption about the appropriate tax rate:

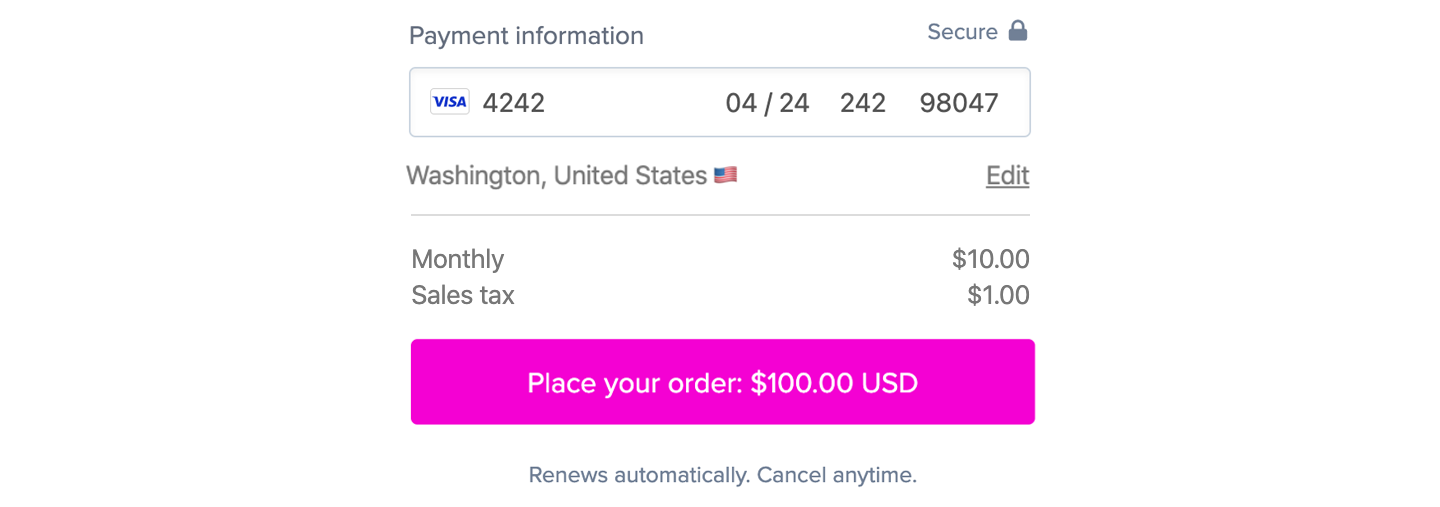

If your business is located in the United States, we need a bit more information before we can calculate the tax rate. Most of the time the credit card field will ask for the payment method’s ZIP Code so, in that case, we’ll use that to calculate the tax rate:

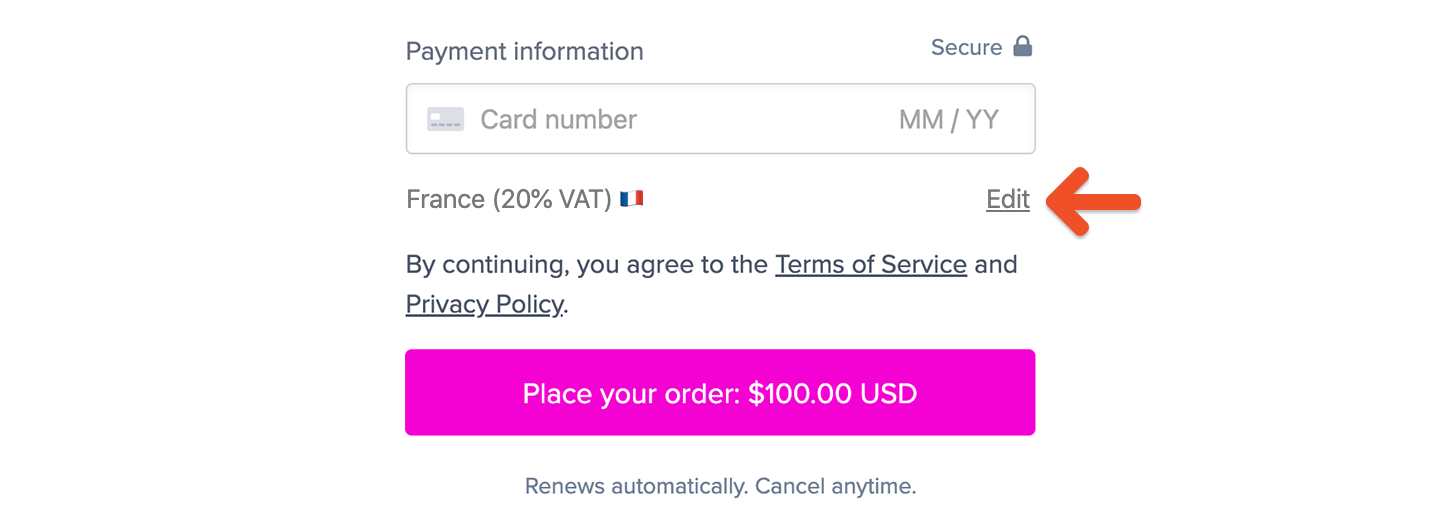

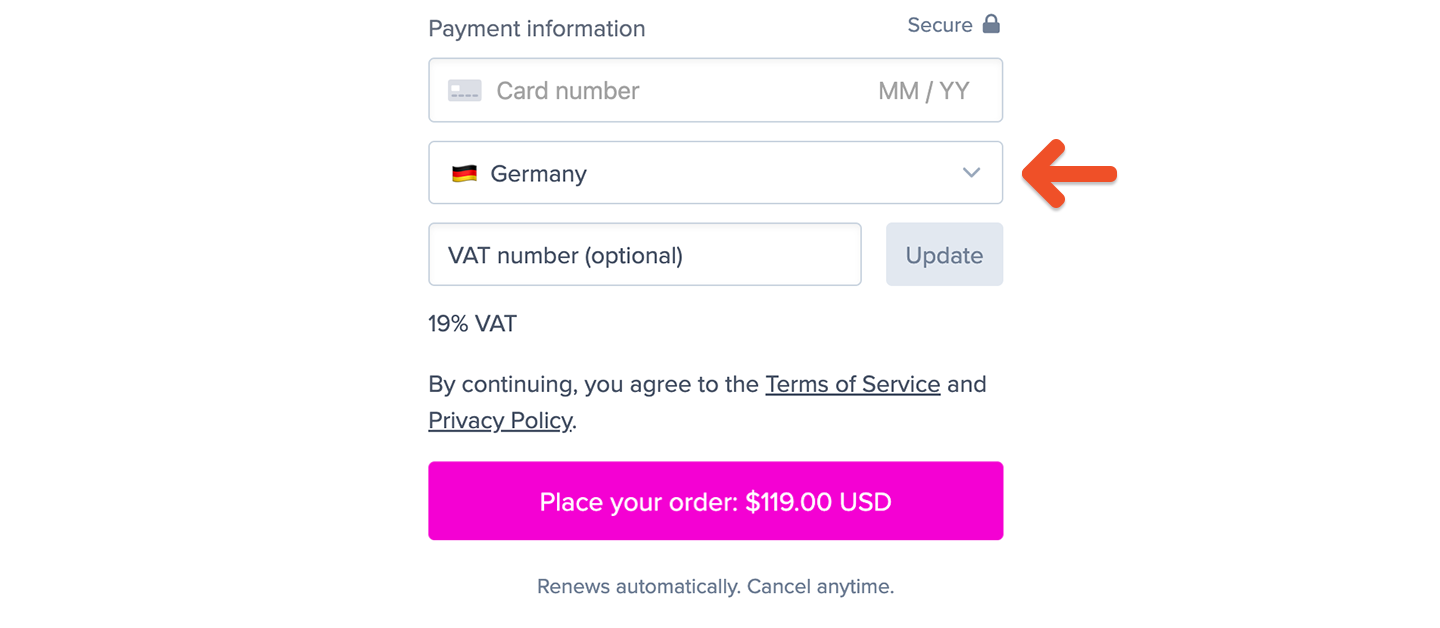

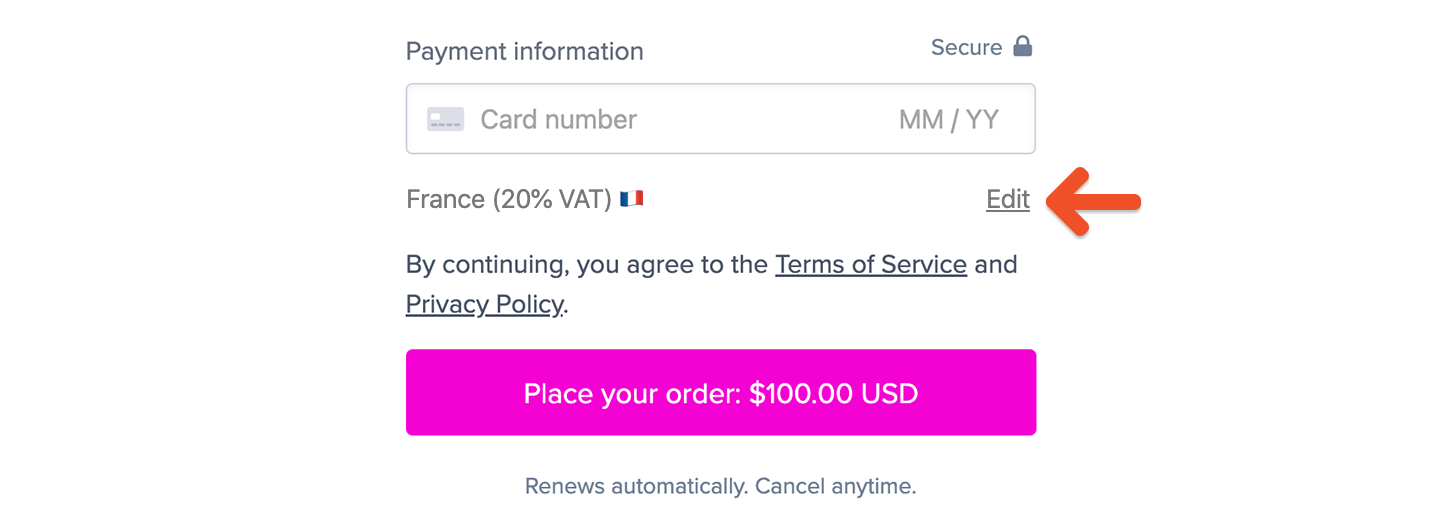

In some cases, regardless of where you are, we might not be able to determine an accurate location immediately. A member might be traveling outside of their home country, using a VPN, etc. As shown above, we always display the location we’re using to calculate the tax rate. If this isn’t accurate, the member should click Edit and select the appropriate country, state, and postal code (if applicable).

Taxes are calculated in the following situations:

- When both your business and the member are in the same U.S. state

- When both your business and the member are in the E.U.

- When both your business and the member are in the U.K.

- When both your business and the member are in Canada

- When both your business and the member are in Australia

Reverse charge mechanism

In the European Union, business to business transactions sometimes treat VAT charges a bit differently. If the member purchasing one of your plans or products has a valid EU VAT number and is located in a different member country than your business, we’ll recalculate the tax rate to 0%—invoking the reverse charge mechanism.

To enter a VAT number within the checkout, the member can click Edit next to the location:

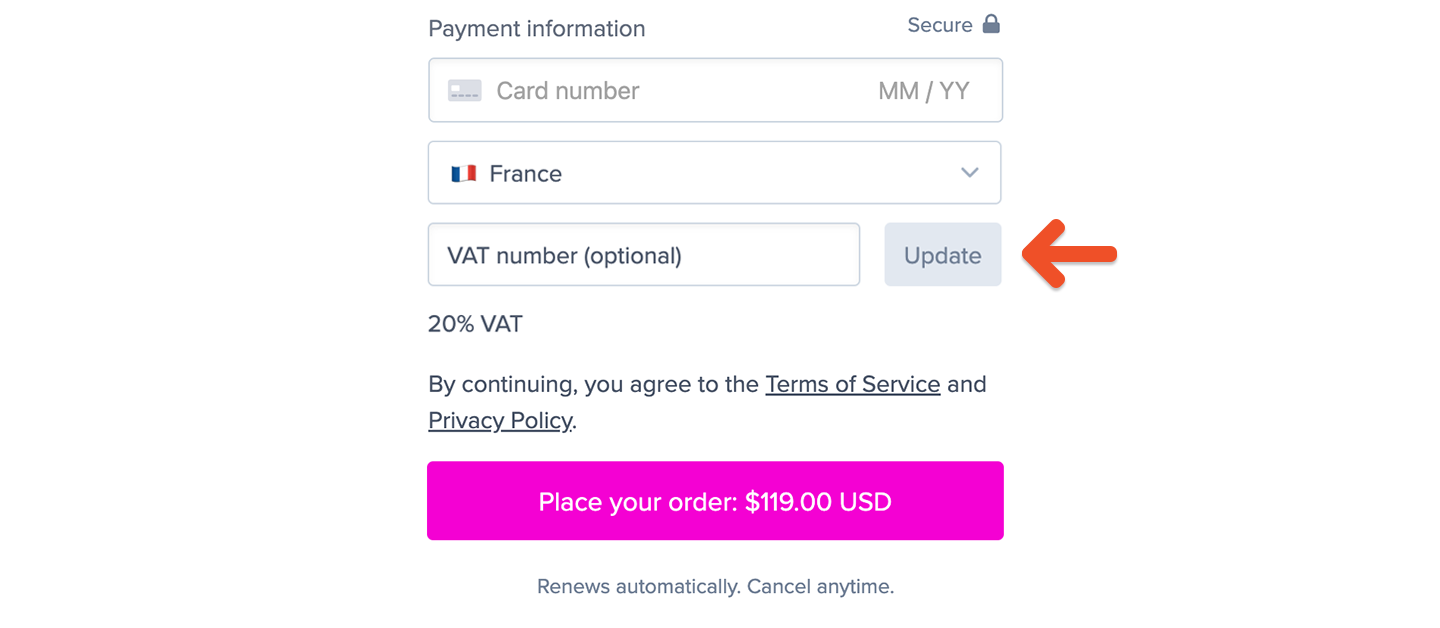

The member will then be able to enter a VAT number:

TaxJar, our tax processor, uses a service called VIES to validate EU VAT IDs. If your member inputs a VAT ID that is not valid, we will display a Wrong Tax ID error message during checkout.

We also support collecting business tax numbers in Canada and Australia, but we don’t currently validate them or apply any reverse charge mechanisms.

If you enabled tax-included pricing and a member is eligible for the reverse charge mechanism, Memberful will remove taxes from the total price.

Existing subscription renewals

After you enable tax collection under the Settings tab, new members will be required to enter their billing location when they sign up. Existing members will be required to enter their billing location when they update their payment method.

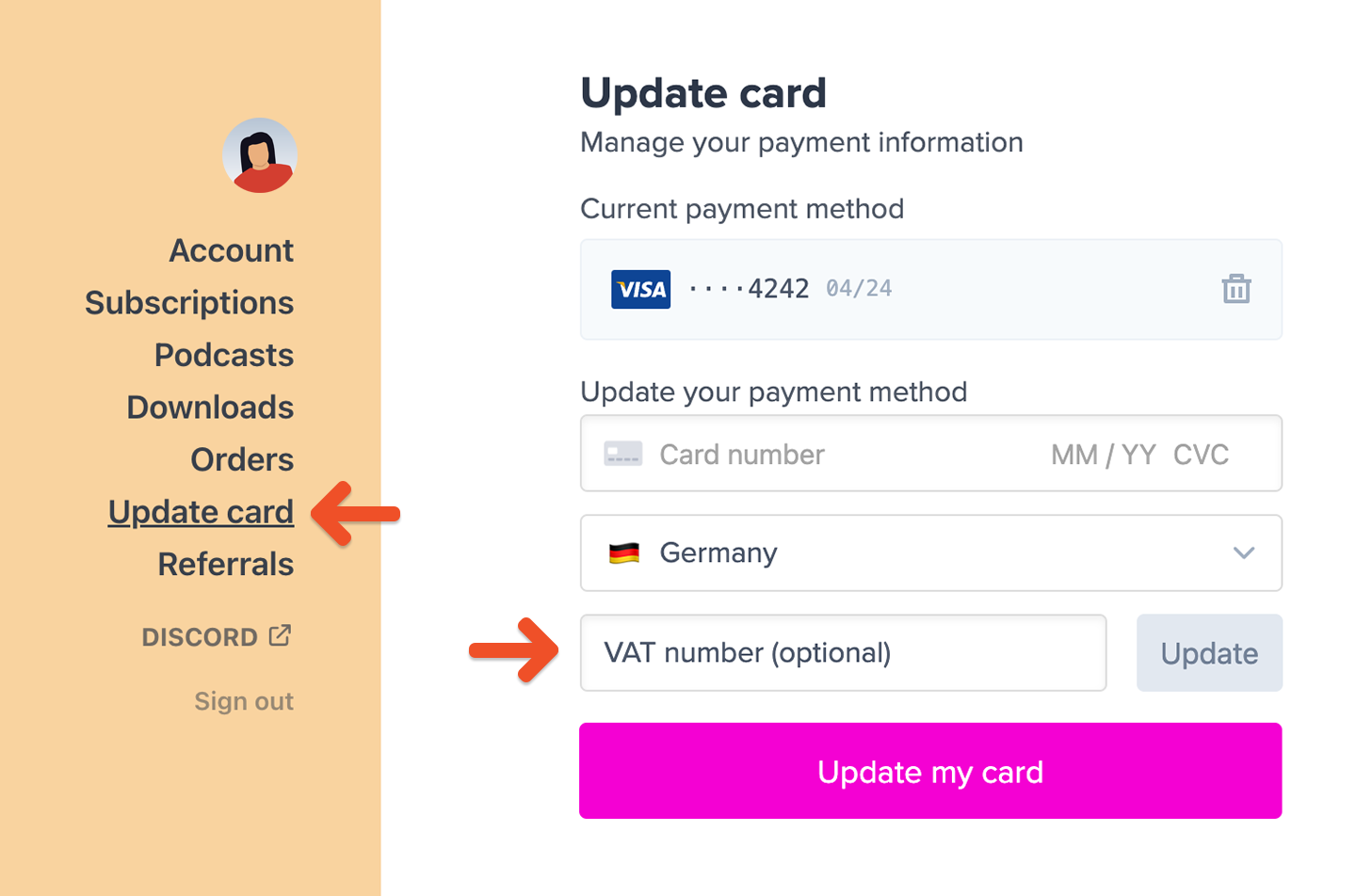

If your site has active subscribers who signed up before you enabled tax collection, those subscriptions will continue to renew as before. Tax will not be collected on renewal orders until the member updates their payment method. You can direct members to update their payment method to add taxes to existing subscriptions by going to Update Card in their account.

Members can also update their Tax/VAT number here anytime (if it's required based on their location). This value can only be updated by the member themselves.

Order receipts / invoices

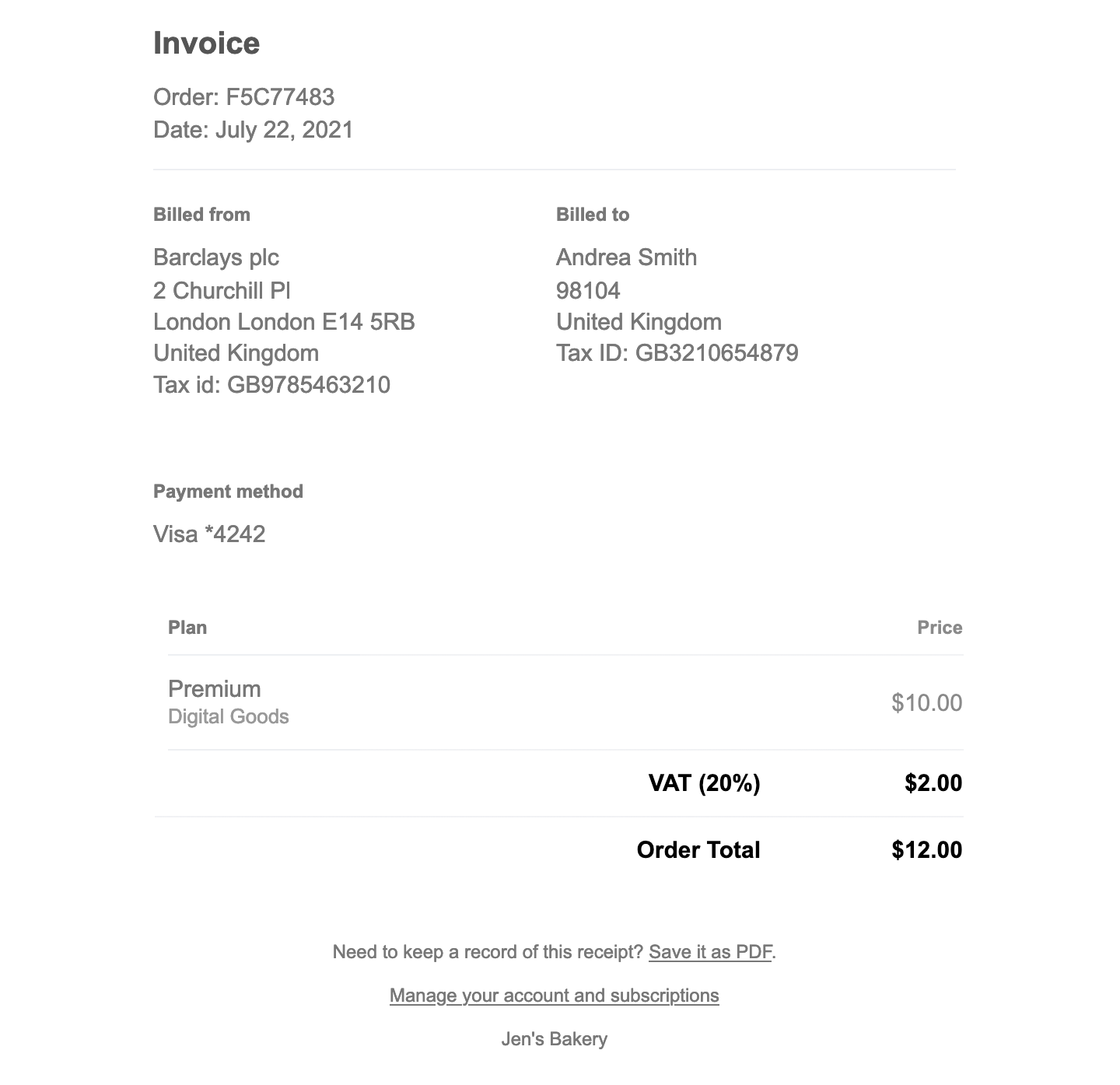

When taxes are collected for an order, we’ll include additional information in the payment receipt / invoice that is emailed to the member. This includes:

- The tax rate and tax amount that was charged

- The total amount that was charged, including taxes

- The member’s billing location

- The member’s tax ID number (if applicable)

- Your business’ tax ID number

- Your business’ nexus address

- Your business’ name (if specified)

Information passed to Stripe

All Memberful transactions are processed using your own Stripe account. Your Stripe account is the most accurate reflection of the funds you’ve received, and therefore is the best resource when it comes to reporting and remitting your taxes.

When you have tax collection enabled, Memberful will pass the following information to your Stripe account in addition to the basics:

- Tax rate collected

- Tax amount collected

- Member’s IP address

- Member’s billing country

- Member’s tax ID number (if applicable)

You can export full CSVs from your Stripe account or integrate with a 3rd party service like TaxJar or Quaderno to automatically analyze and report your taxes to the government.

Related help doc:

- Display terms of service and privacy policy links in your checkout form.

- Choose your currency to sell to members.

- Customize your branding through colors and logos.

Can't find what you're looking for?

We'd love to help! You'll hear back within a few hours Monday–Friday.