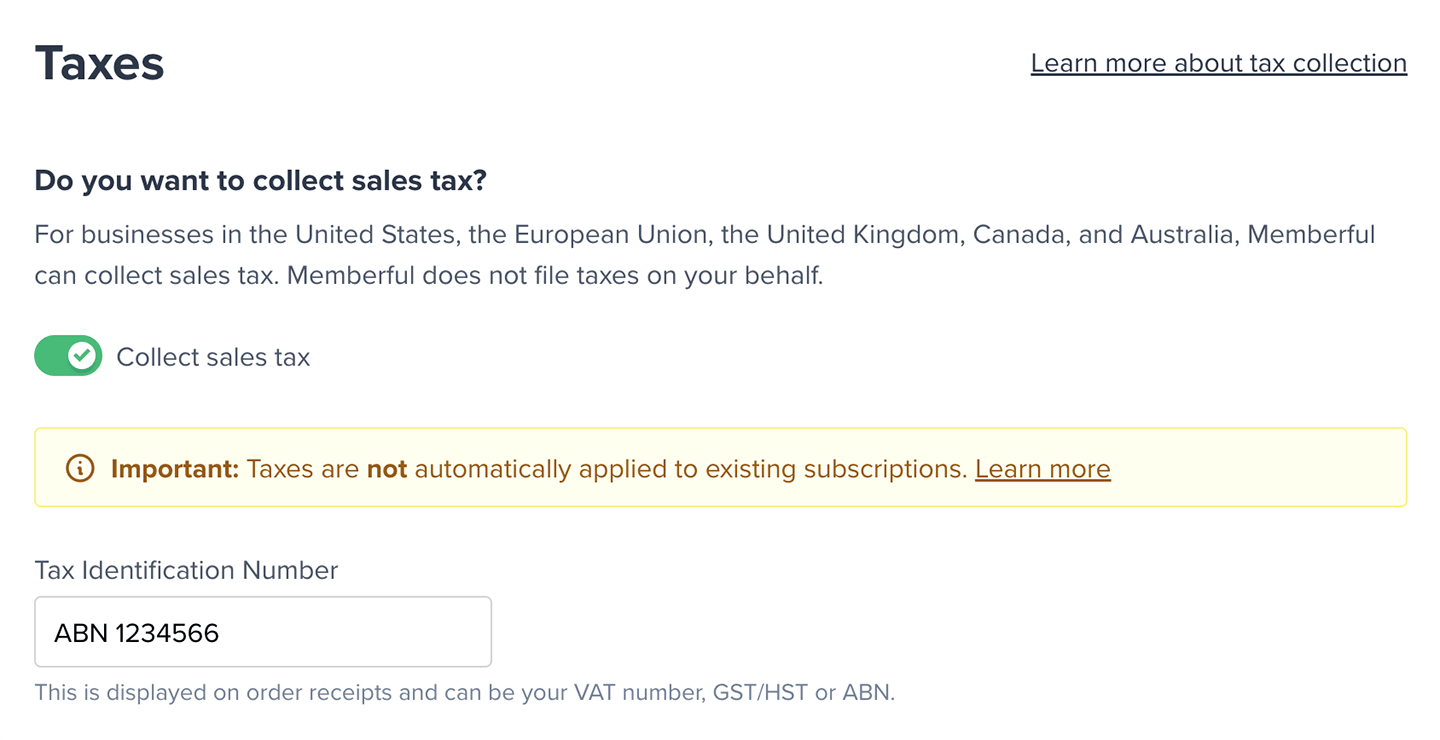

Enable tax collection

Memberful does not file or remit taxes on your behalf to the government; we simply help you collect the appropriate taxes at the time of the transaction. You’ll still need to remit taxes on your own. We pass information to your Stripe account to make that easier. By default, taxes are not collected when members go through your checkout. To enable tax collection, navigate to Settings → Taxes in your Memberful dashboard and enable the Collect sales tax option.

If you aren’t sure if you need to collect taxes or have additional questions, we recommend speaking with a licensed tax professional since requirements may differ depending on the location of your business.

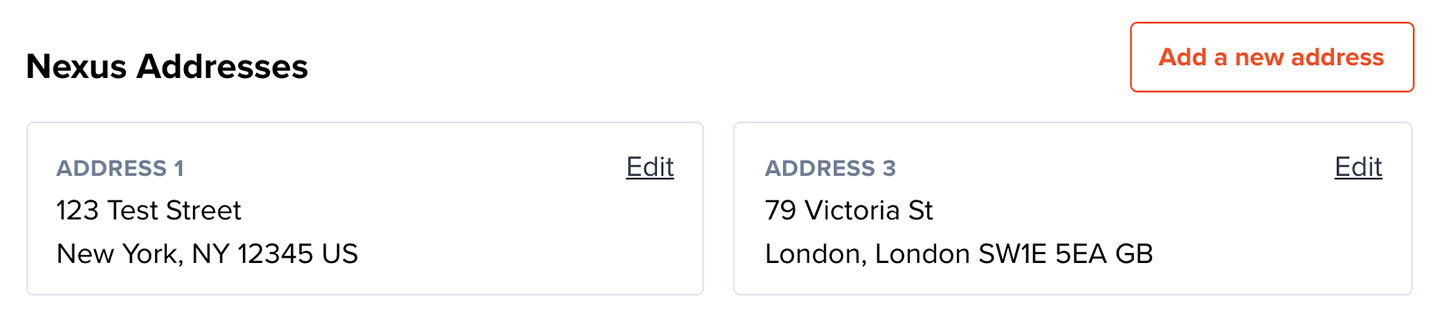

Input locations where your business has economic nexus

Once you enable this setting, you’ll need to input the location(s) where your business has an economic nexus. These locations are compared against where your members are located so that Memberful can calculate the appropriate taxes (if any) that should be applied to their order.

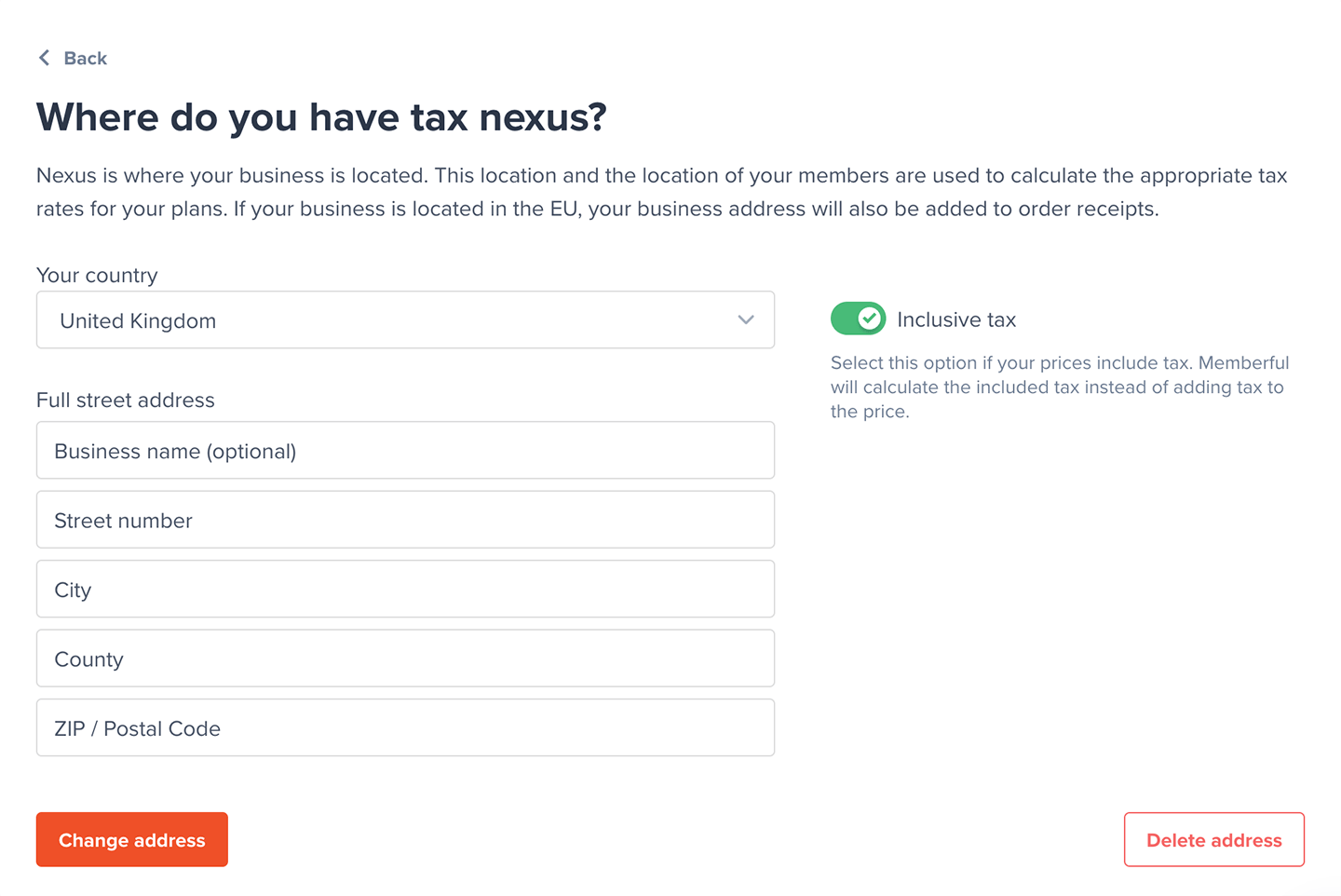

Tax excluded vs. Tax included

By default, all your prices are tax excluded. If we determine that a member should pay taxes on a given order, we’ll add the taxes on top of the subtotal. If you prefer to have taxes included in your price, you can do so on a per-nexus basis. For example, if you want to include taxes only for your European members, go to your European Nexus Address (Settings → Taxes), edit a Nexus Address, and enable the Inclusive tax option.

Keep in mind that if you lowered your plan prices to account for taxes not being included, you’ll need to revert your price back to “normal” after enabling tax-inclusive pricing.

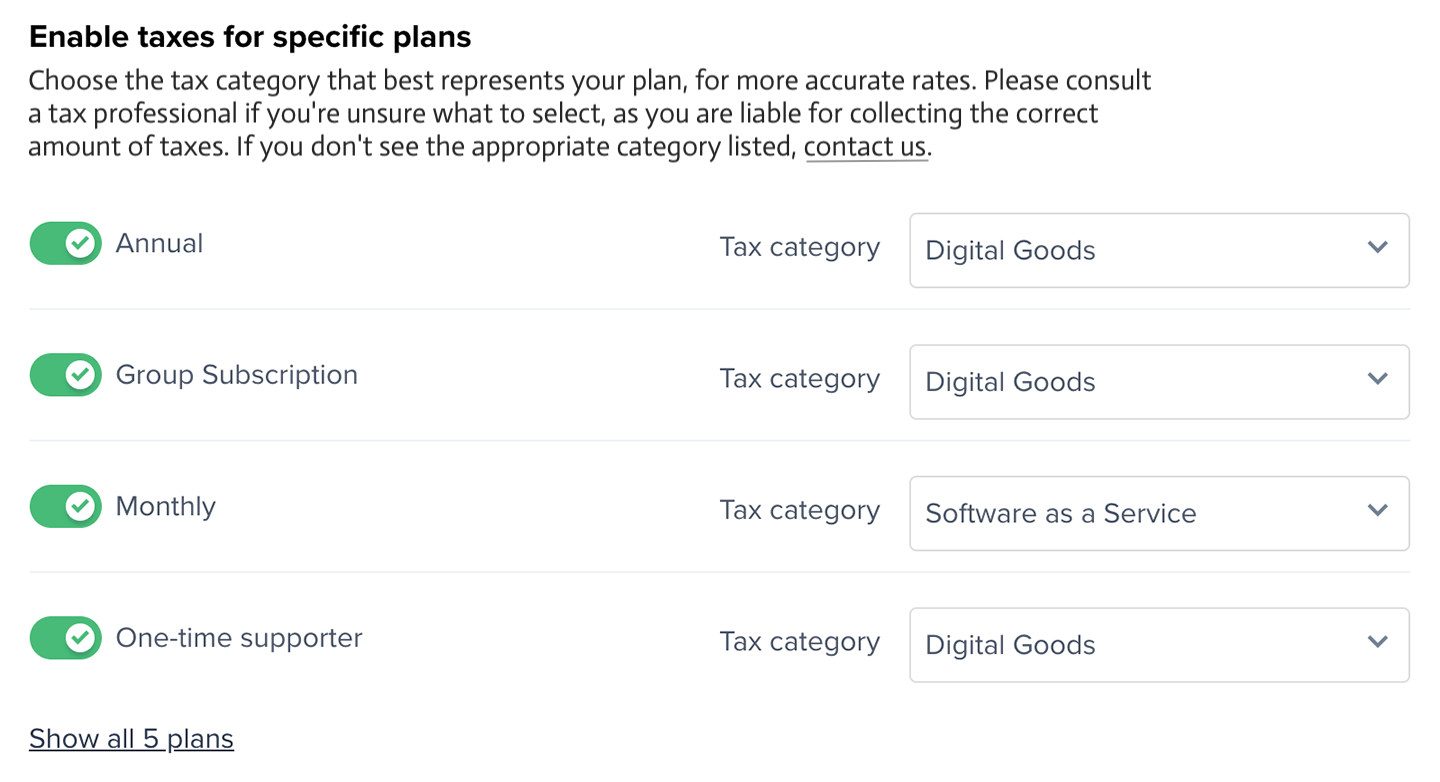

Enable taxes for specific plans

You can enable taxes on a per-plan basis and select a corresponding tax category. We default to Digital Goods. Choose the tax category that best represents your plan for more accurate rates. Please consult a tax professional if you’re unsure what to select, as you are liable for collecting the correct amount of taxes.

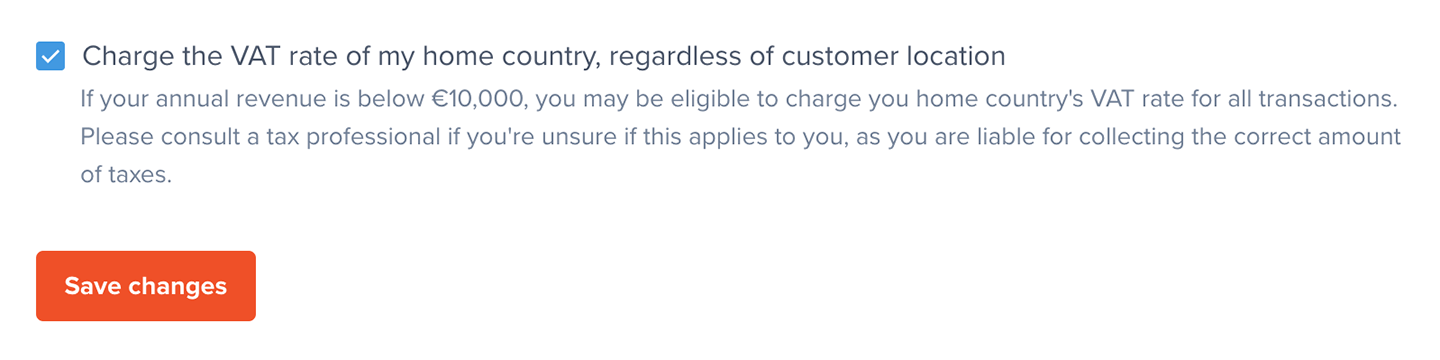

Charge the VAT rate of your home country (EU only)

If your annual revenue is below €10,000, you may be eligible to charge your home country’s VAT rate for all transactions. Please consult a tax professional if you’re unsure if this applies to you, as you are liable for collecting the correct amount of taxes.

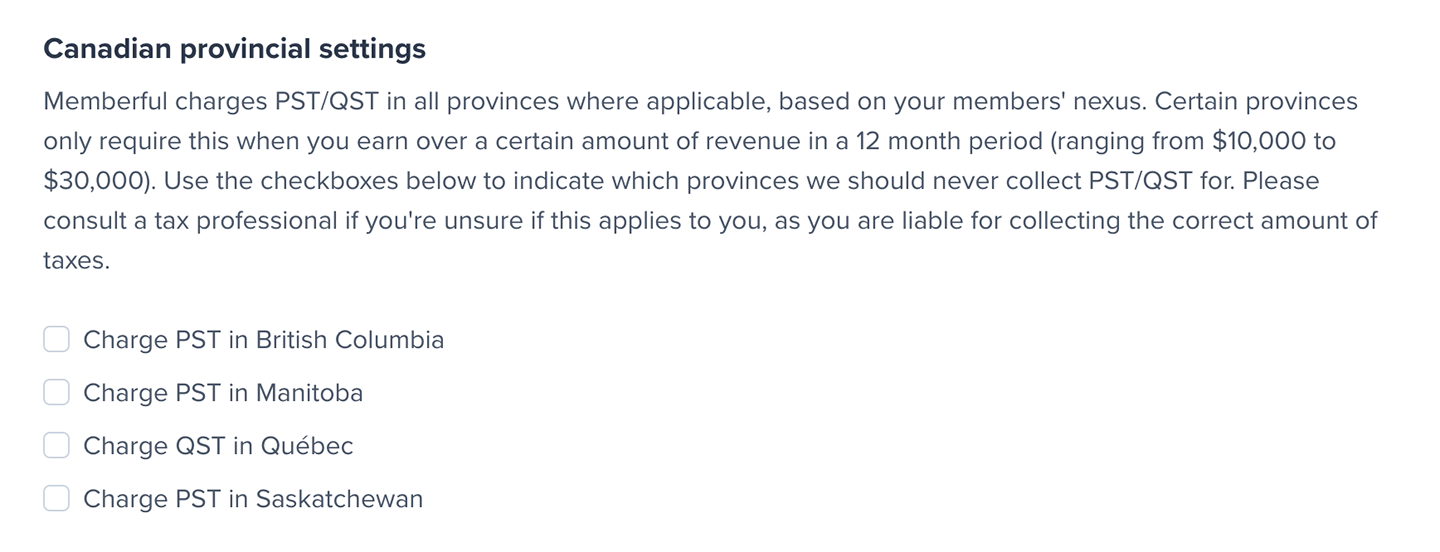

Charge provincial taxes with a Canadian Nexus address (Canada only)

Several provinces in Canada have updated their tax laws to require registration and tax collection when a company has more than a certain amount of revenue in the span of 12 months. These thresholds are different for each province, as are the local tax rates. Once the threshold is crossed, they require businesses to collect Provincial Sales Tax/PST (or Quebec Sales Tax/QST in Quebec) in addition to the country-wide 5% Goods and Services Tax (GST) rate. When a company is below the threshold, it only charges the 5% GST. The four provinces where this applies are:- British Columbia (BC)

- Manitoba (MB)

- Quebec (QC)

- Saskatchewan (SK)

Member checkout flow

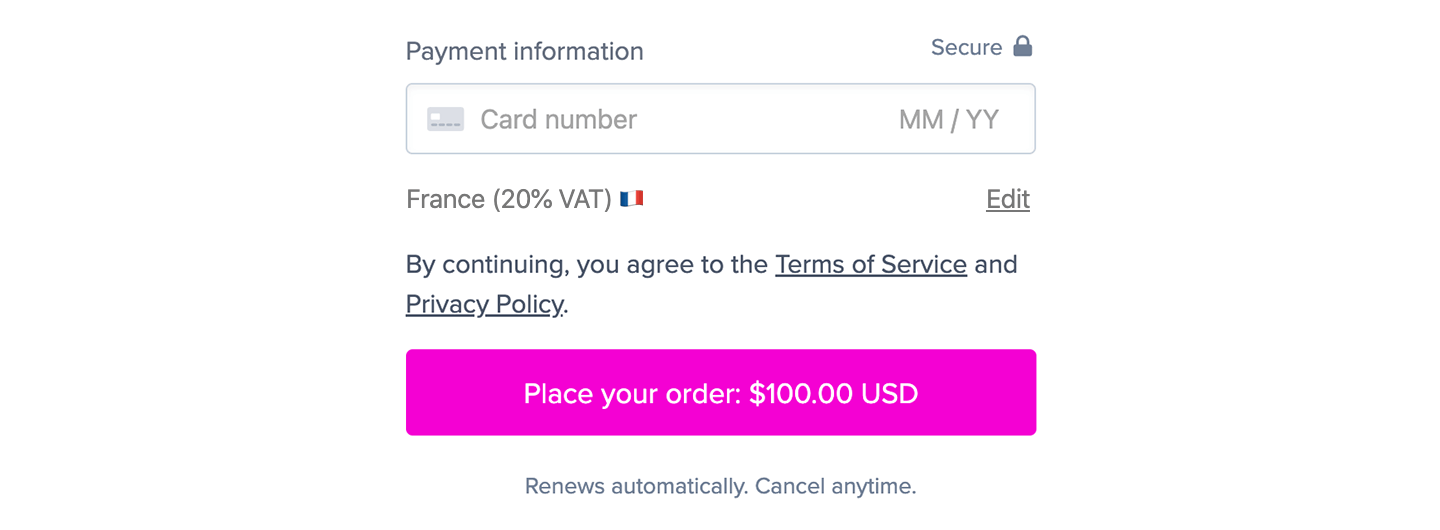

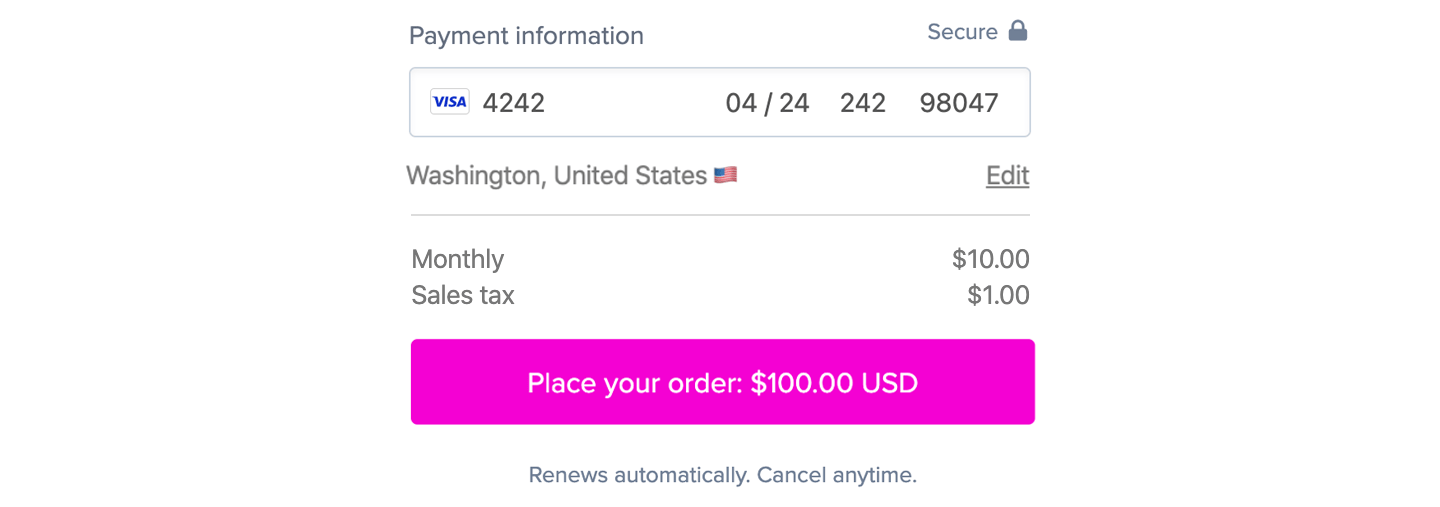

Once you have taxes enabled and a member enters your checkout flow, we determine their location to calculate which taxes need to be applied (if any). The information we collect varies based on where you have an economic nexus. For example, in the European Union, we verify two non-conflicting pieces of location evidence to ensure your business’s legal compliance when it comes to remitting taxes. We always strive to provide a high-converting checkout flow, and therefore, we do our best to calculate the appropriate tax rate with little or no extra action required from your members. When members enter the checkout flow, we detect which country they’re currently located in using their IP address. Depending on where your business is located, in the EU, for example, that may be enough information to make an initial assumption about the appropriate tax rate:

- When both your business and the member are in the same U.S. state

- When both your business and the member are in the E.U.

- When both your business and the member are in the U.K.

- When both your business and the member are in Canada

- When both your business and the member are in Australia

Reverse charge mechanism

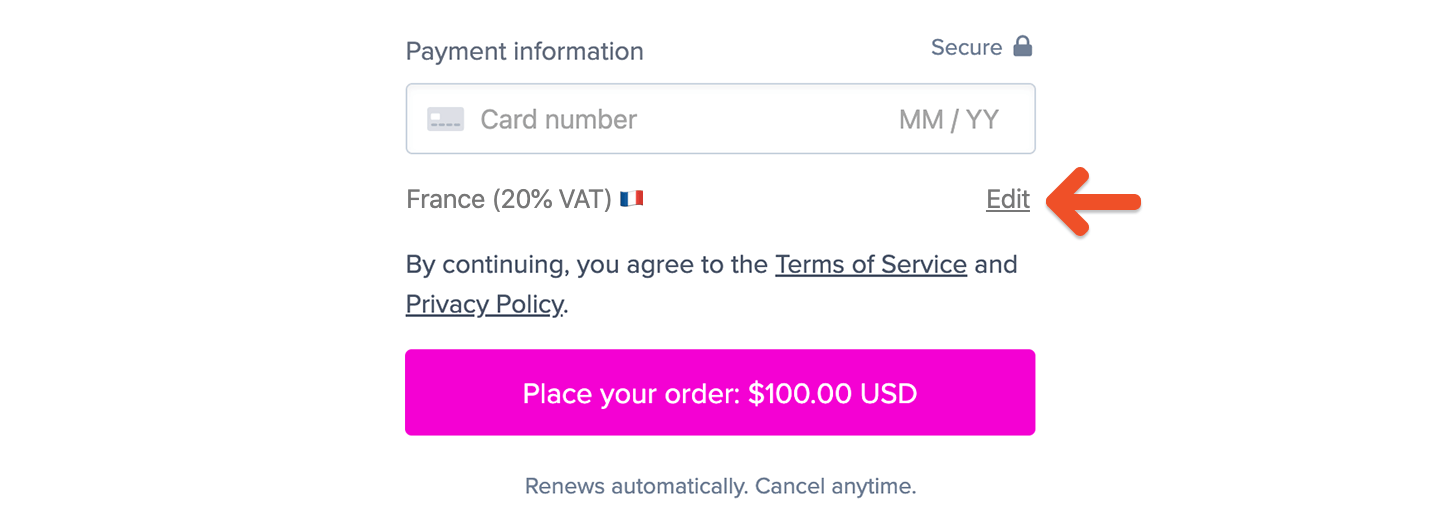

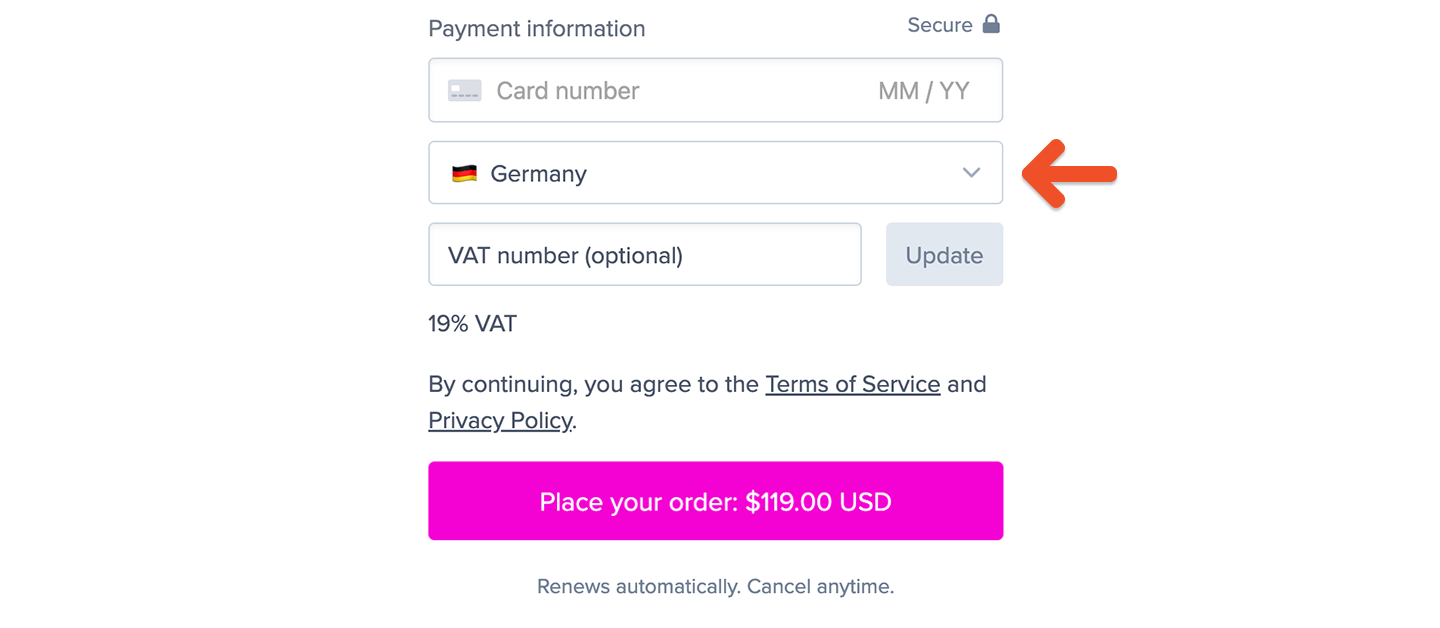

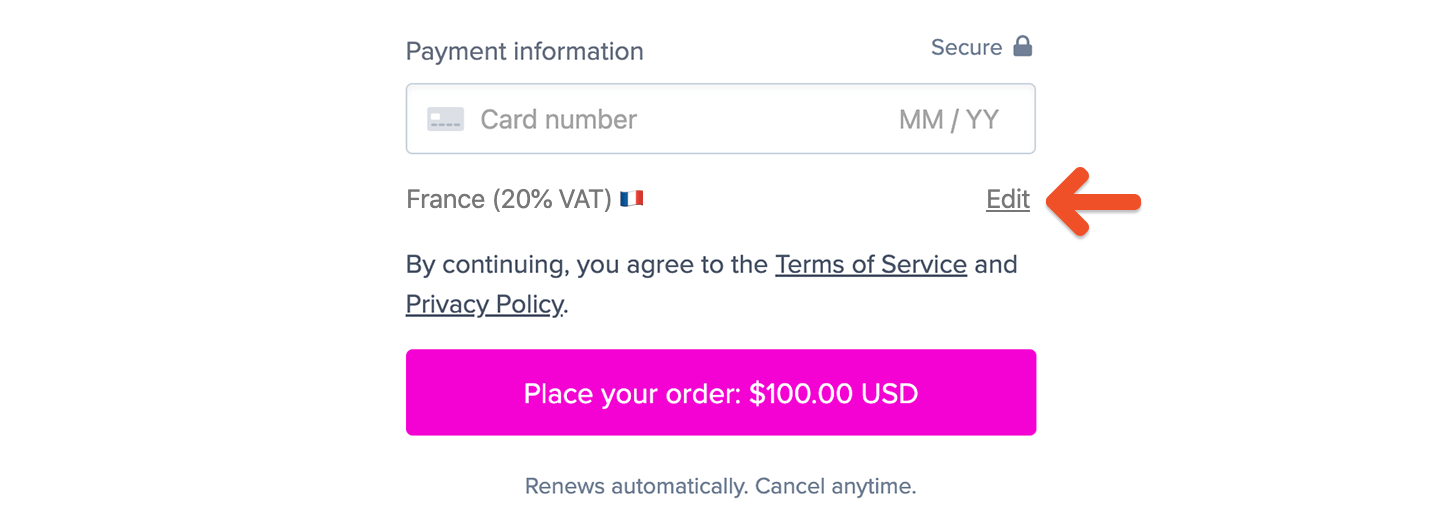

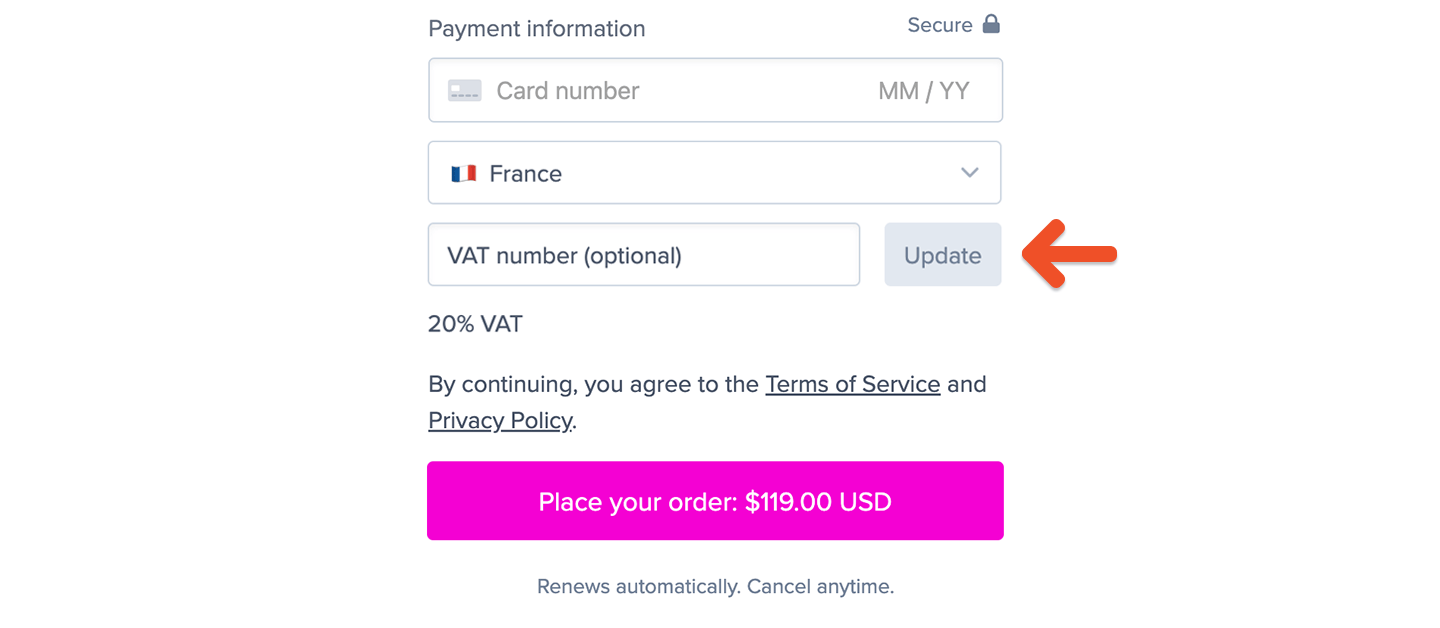

In the European Union, business to business transactions sometimes treat VAT charges a bit differently. If the member purchasing one of your plans or products has a valid EU VAT number and is located in a different member country than your business, we’ll recalculate the tax rate to 0%—invoking the reverse charge mechanism. To enter a VAT number within the checkout, the member can click Edit next to the location:

If you enabled tax-included pricing and a member is eligible for the reverse charge mechanism, Memberful will remove taxes from the total price.

Existing subscription renewals

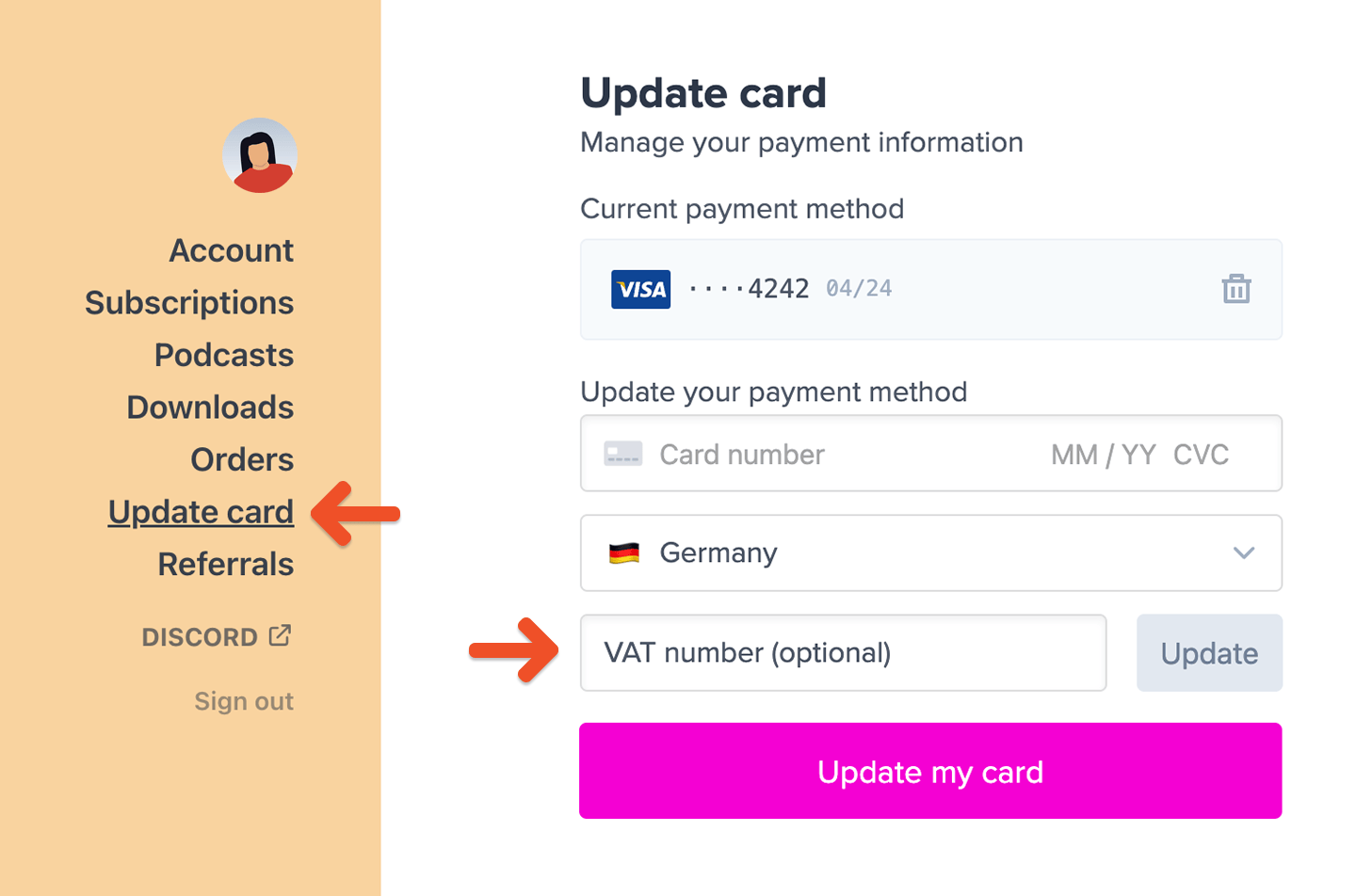

After you enable tax collection under the Settings tab, new members will be required to enter their billing location when they sign up. Existing members will be required to enter their billing location when they update their payment method. If your site has active subscribers who signed up before you enabled tax collection, those subscriptions will continue to renew as before. Tax will not be collected on renewal orders until the member updates their payment method. You can direct members to update their payment method to add taxes to existing subscriptions by going to Update Card in their account. Members can also update their Tax/VAT number here anytime (if it’s required based on their location). This value can only be updated by the member themselves.

Order receipts / invoices

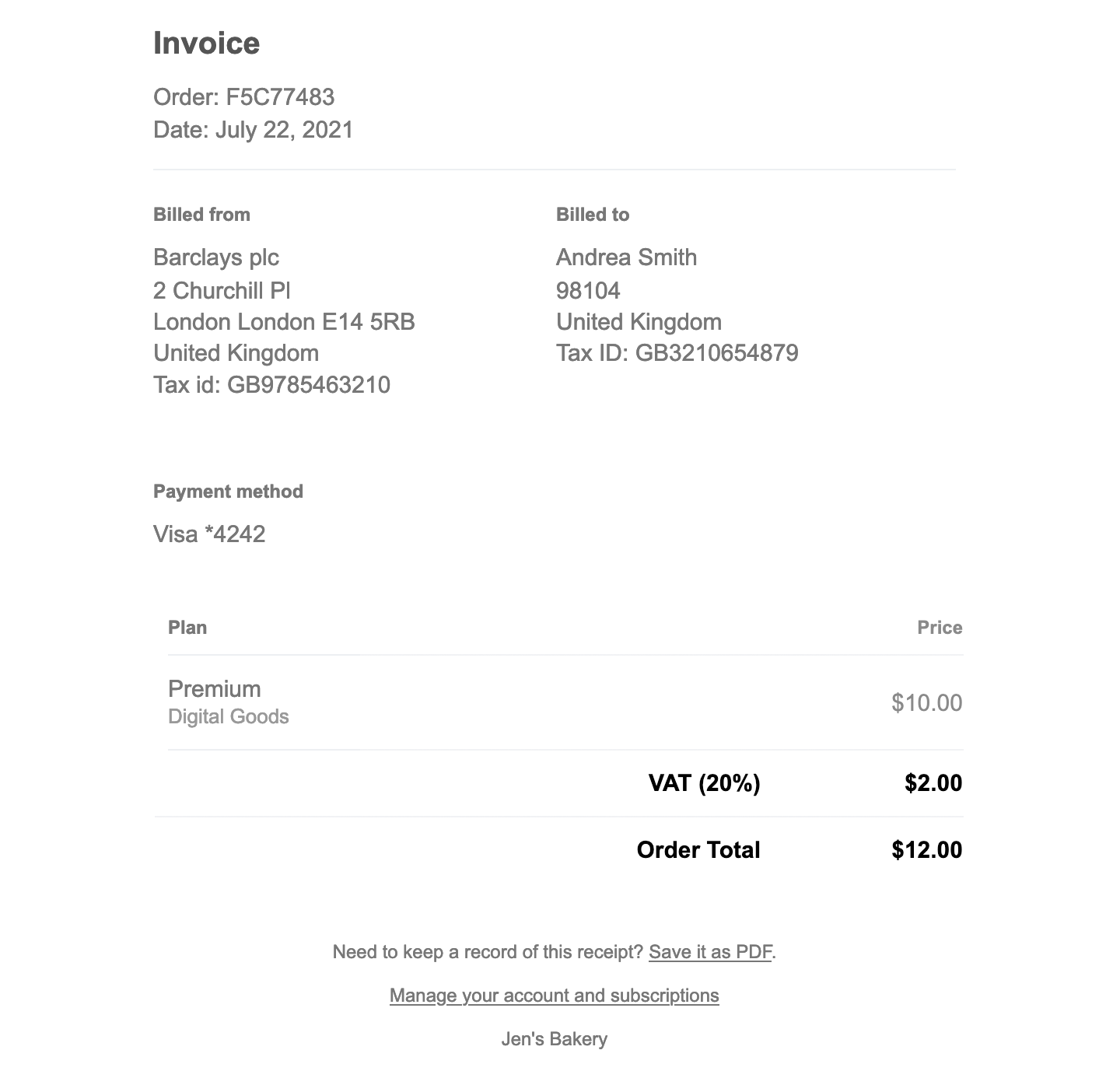

When taxes are collected for an order, we’ll include additional information in the payment receipt / invoice that is emailed to the member. This includes:- The tax rate and tax amount that was charged

- The total amount that was charged, including taxes

- The member’s billing location

- The member’s tax ID number (if applicable)

- Your business’s tax ID number

- Your business’s nexus address

- Your business’s name (if specified)

Information passed to Stripe

All Memberful transactions are processed using your own Stripe account. Your Stripe account is the most accurate reflection of the funds you’ve received, and therefore is the best resource when it comes to reporting and remitting your taxes. When you have tax collection enabled, Memberful will pass the following information to your Stripe account in addition to the basics:- Tax rate collected

- Tax amount collected

- Member’s IP address

- Member’s billing country

- Member’s tax ID number (if applicable)