Stripe competitors: Finding the best payment processor for you

Stripe is a payment processing platform that allows global businesses of all sizes to accept payments online (and in person). But we're aware there are several strong competitiors in the market and so Stripe may not be the best payment processor for your business. That will depend on a number of factors, such as the type of business you have, the countries you operate in, the payment methods you need to accept and the features and pricing offered by each platform.

We're here to help you compare some popular Stripe competitors to see which is most relevant for you and your business!

Why is Stripe popular?

For some quick context, let's look at why Stripe is one of the most well-known payment processors in the world. Its security, accessibility and portability make it a popular choice for business owners. For example, here at Memberful, we use Stripe to process the financial transactions involved in your membership businesses.

Stripe accepts payment methods from over 135 countries and in over 135 currencies. These methods includes major credit cards, digital wallets such as Apple Pay and Google Pay, and online ACH (Automated Clearing House) payments. Stripe is a PCI DSS Level 1 service provider, and it uses the latest technologies to protect businesses and their customers.

Stripe offers a transparent pricing model that applies to all types of payments. Here is a table that summarizes Stripe's pricing model:

- U.S. card payments: 2.9% + 30¢

- International card payments: 3.9% + 30¢

- ACH payments: 1% (minimum $0.30)

- Wire transfers: 0.15% (minimum $15)

In addition to transaction fees, Stripe also charges a small fee for certain features, such as Radar for fraud protection and Billing for managing recurring payments. However, these fees are typically waived for businesses that process a high volume of payments.

Which Stripe competitor is best for you?

Now let's take a look at some other options. We’ll dive deep into each individual competitor below, but first let’s set up a comparison of these Stripe competitors in the context of your type and size of business:

SMEs

If you are a small or medium business, you may want to consider using a payment processor like Stripe, Square, or Authorize.net. These payment processors offer a variety of features that are well-suited for small businesses, such as affordable pricing, easy setup, and user-friendly interfaces.

Enterprise

If you are a large business, you may want to consider using a payment processor like Adyen, Worldpay, or Braintree. These payment processors offer a wider range of features and support for more payment methods than payment processors for small businesses.

Global business

If you need to accept payments from international customers, you may want to consider using a payment processor like 2Checkout, Mollie, or Payoneer. These payment processors specialize in a variety of features for managing international payments, such as currency conversion and fraud protection.

Competitors to Stripe

Below are a few popular Stripe competitors but please note there may be something more relevant to your and your work. To make sure you have the best payment service for your business, it’s helpful to ask friends and colleagues for feedback, or to read reviews from other businesses.

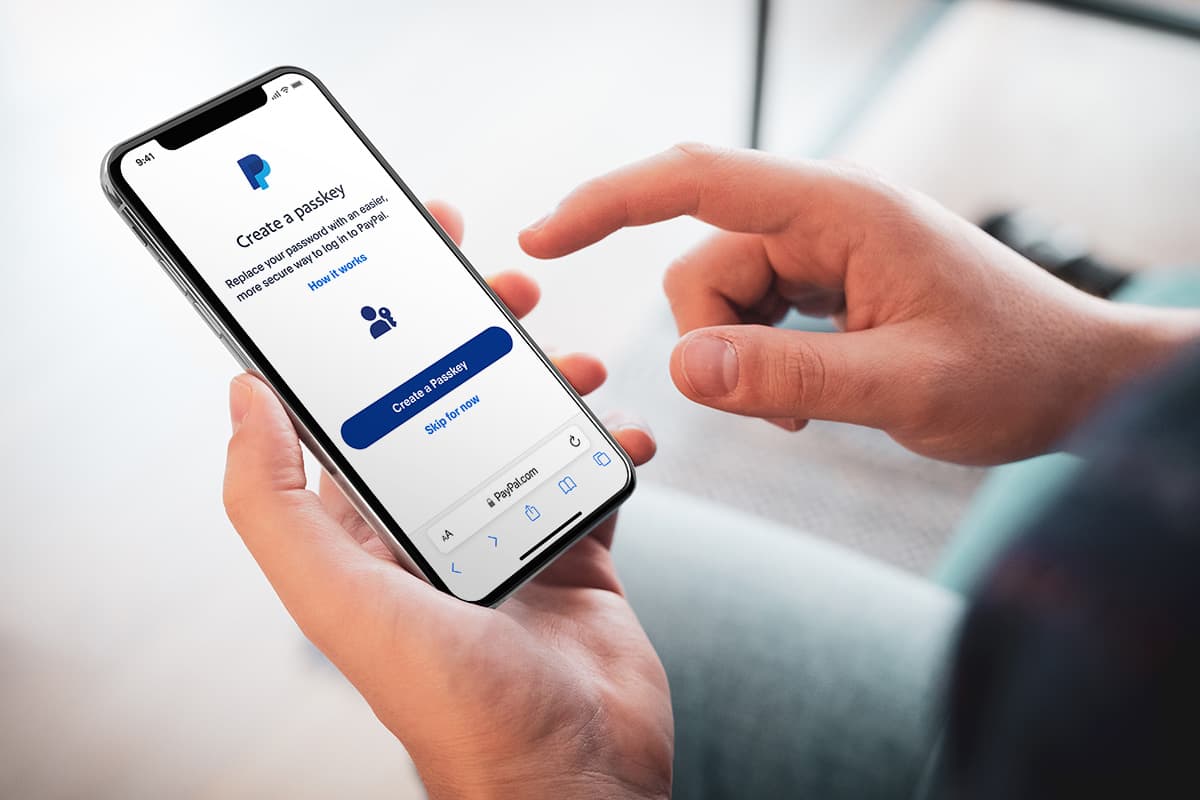

PayPal

PayPal is a popular online payment processor that offers a wide range of features, including the ability to accept payments from major credit and debit cards, as well as PayPal accounts.

PayPal also offers a number of business-friendly features, such as invoicing and recurring billing.

PayPal also offers a number of business-friendly features, such as invoicing and recurring billing.

For more information, see our in-depth review of Stripe vs Paypal.

Adyen

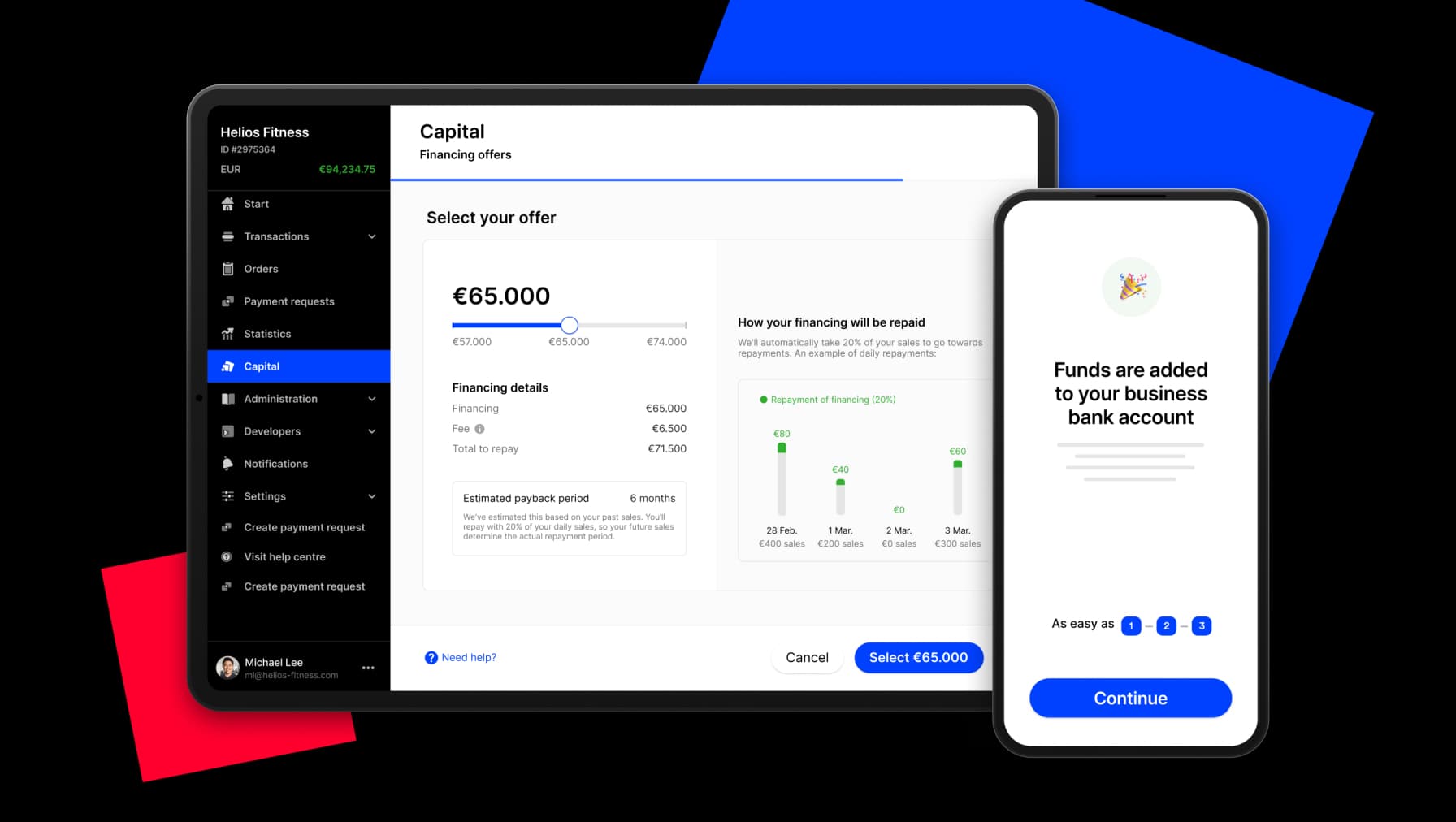

Adyen is a global payment processor that offers a wide range of payment methods, including credit and debit cards, e-wallets, and bank transfers.

Adyen is particularly well-suited for large businesses and enterprises, as it offers a variety of features for managing global payments.

Adyen is particularly well-suited for large businesses and enterprises, as it offers a variety of features for managing global payments.

Square

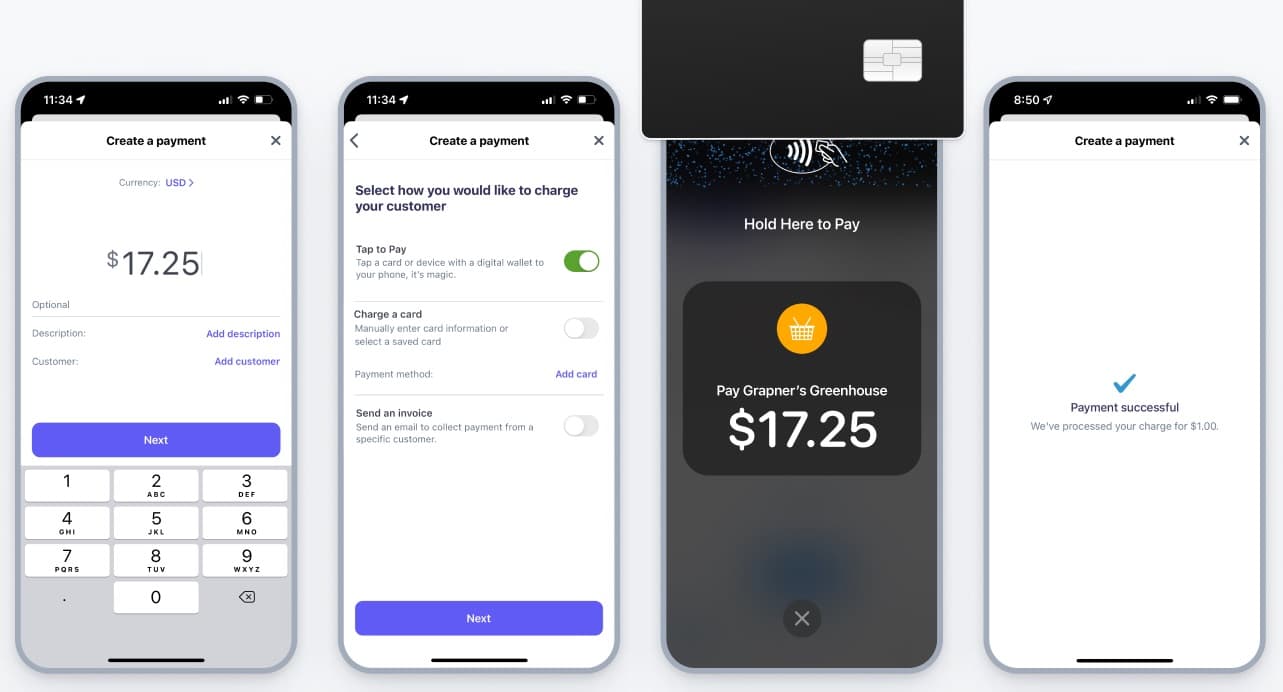

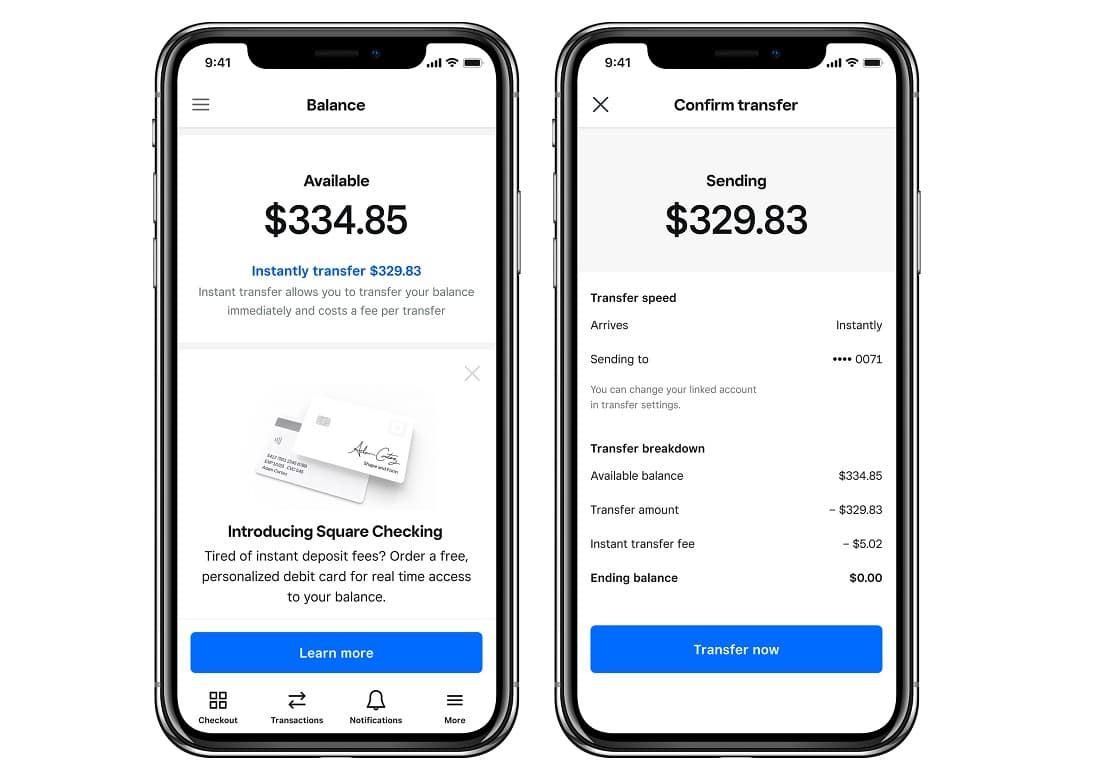

Square is a payment processor for small businesses developed by Block, Inc (which was also created by Twitter founder Jack Dorsey).

It offers a variety of features, including a point-of-sale system, online payment processing, and inventory management. Square is also known for its affordable pricing.

It offers a variety of features, including a point-of-sale system, online payment processing, and inventory management. Square is also known for its affordable pricing.

Authorize.net

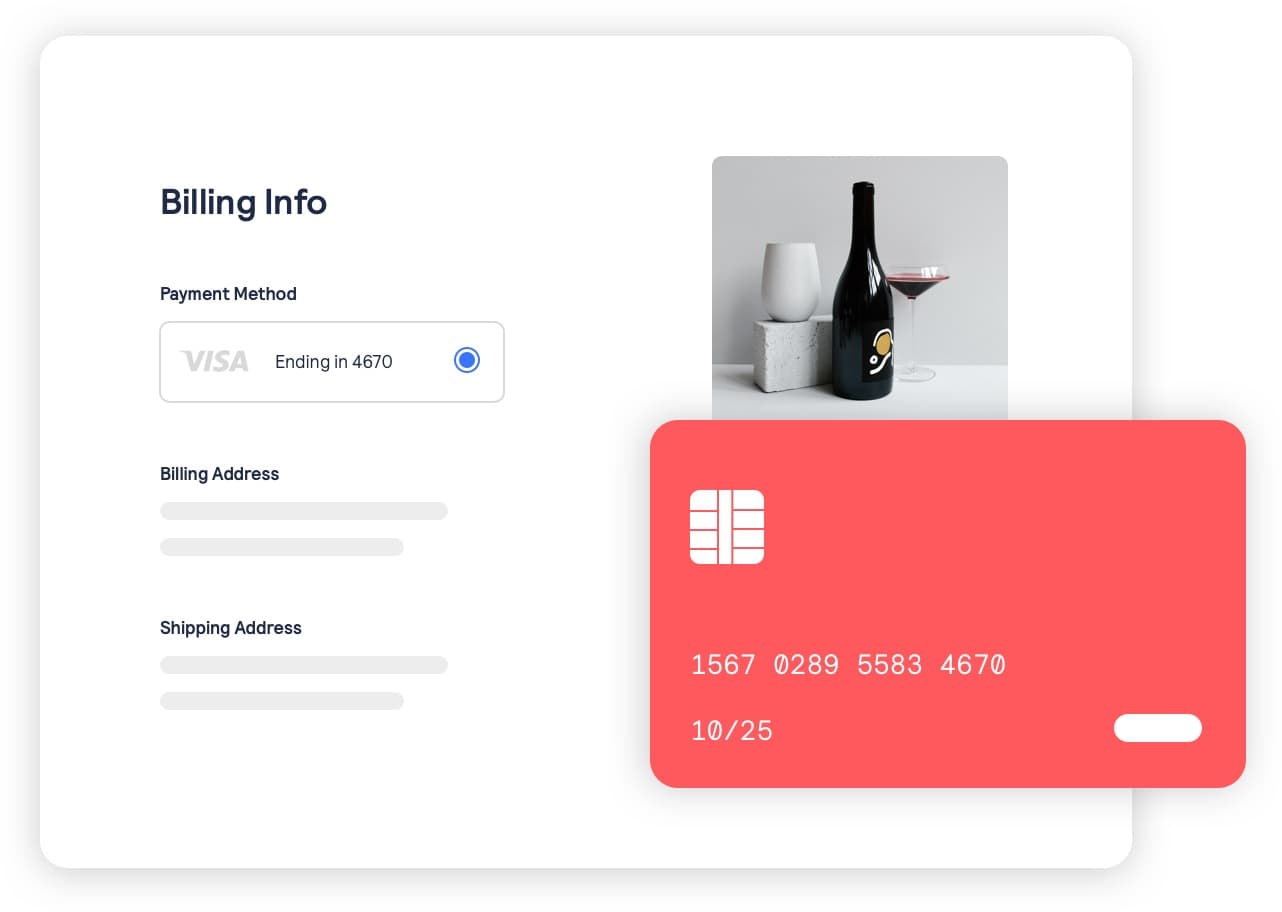

Authorize.net is another popular payment processor for small businesses. It offers a variety of features, including online payment processing, recurring billing, and fraud protection.

Authorize.net also offers a variety of pricing plans to fit the needs of different businesses.

Authorize.net also offers a variety of pricing plans to fit the needs of different businesses.

Braintree

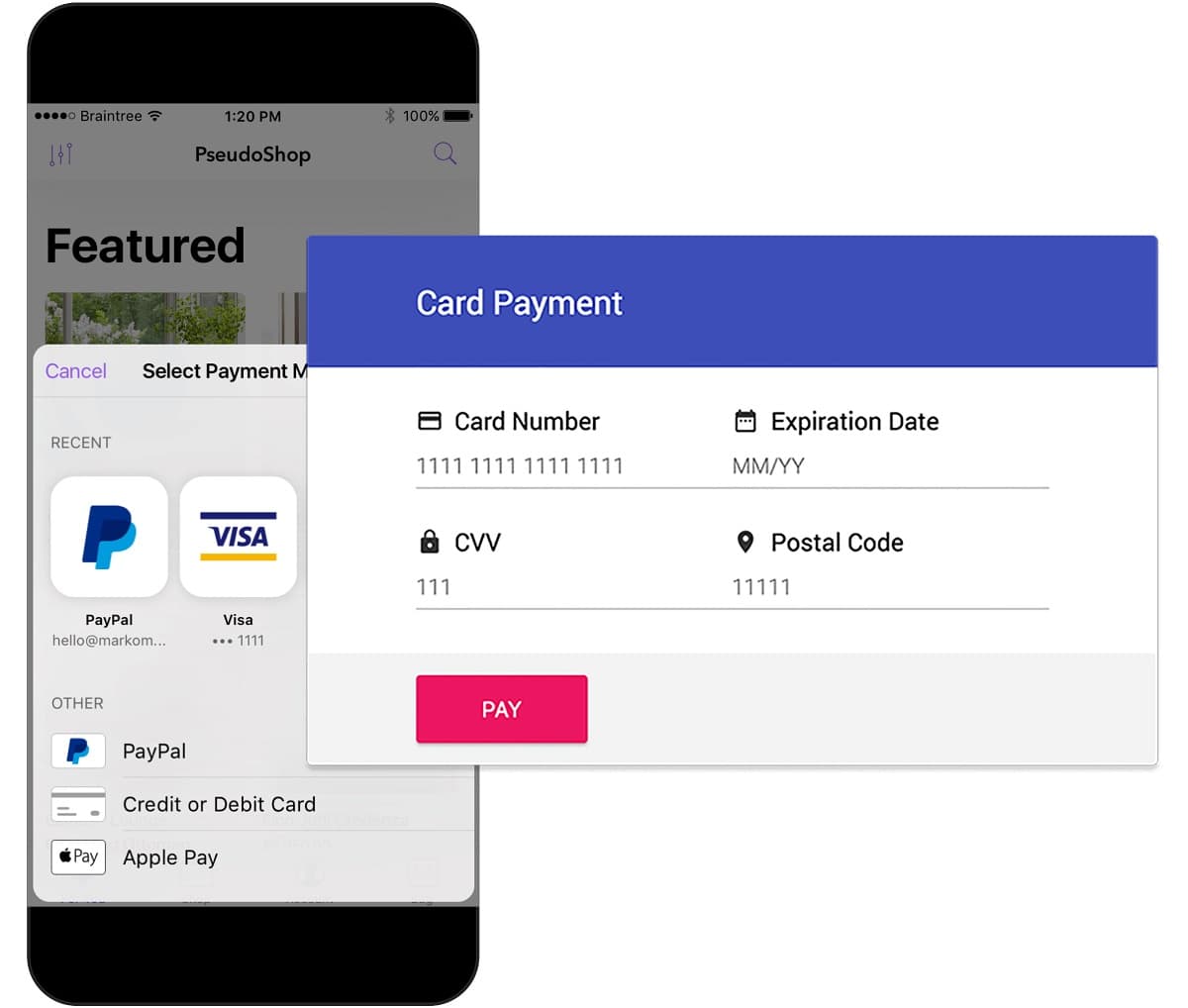

Braintree is a payment processor that is owned by PayPal. It offers a variety of features, including online payment processing, mobile payments, and fraud protection.

Braintree is particularly well-suited for businesses that need to accept payments from multiple channels, such as online, mobile, and in-person.

Braintree is particularly well-suited for businesses that need to accept payments from multiple channels, such as online, mobile, and in-person.

GoCardless

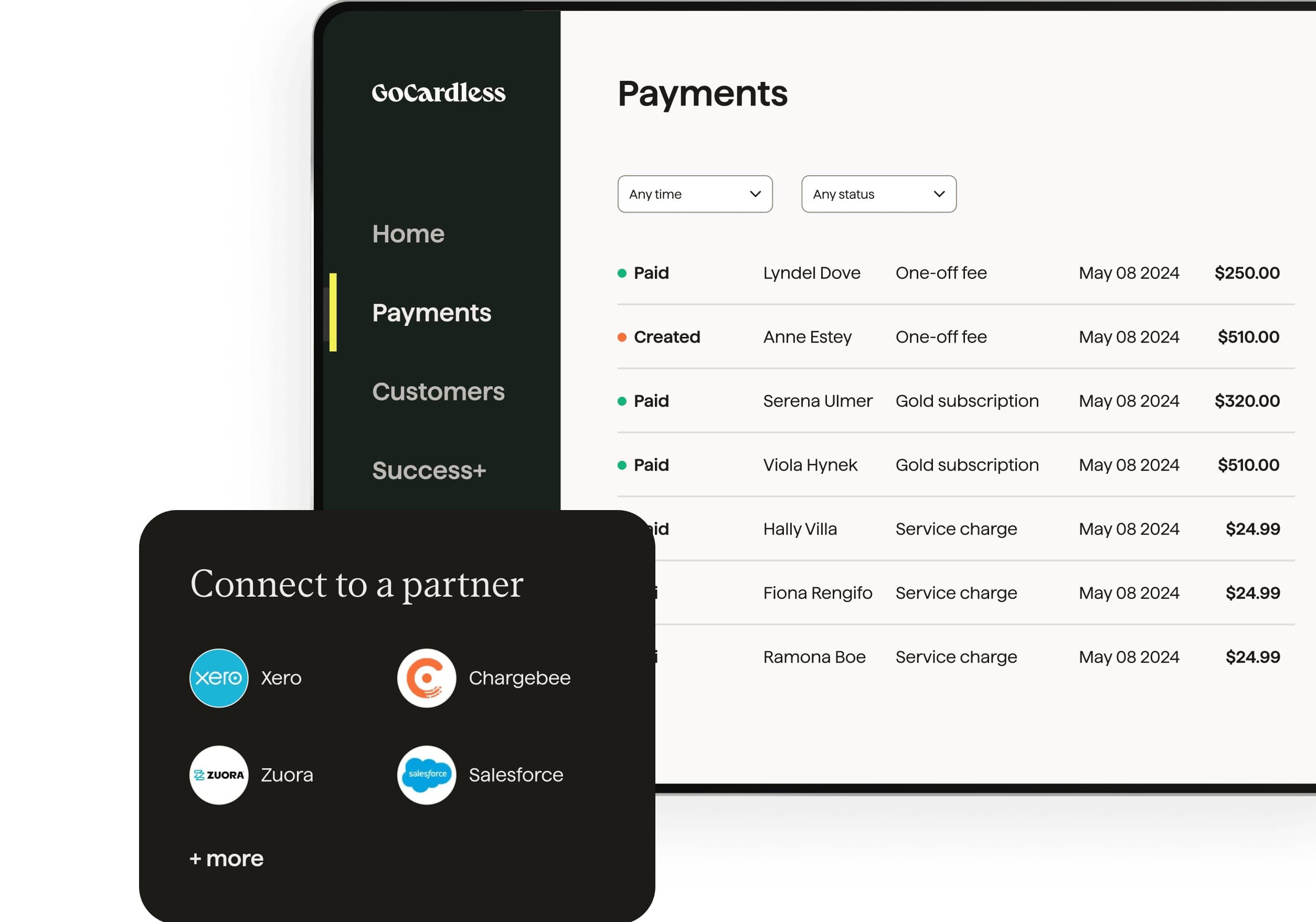

GoCardless is a British payment processor that specializes in direct debit payments and open banking.

It is a good option for businesses that need to collect recurring payments from customers, such as for membership businesses.

It is a good option for businesses that need to collect recurring payments from customers, such as for membership businesses.

Mollie

Mollie is an Amsterdam-based payment processor that is well-suited for businesses that need to accept payments from European customers. It offers a wide range of payment methods, including credit and debit cards, e-wallets, and bank transfers.

Mollie also offers a variety of features for managing European payments, such as SEPA direct debit and iDEAL.

Mollie also offers a variety of features for managing European payments, such as SEPA direct debit and iDEAL.

Worldpay

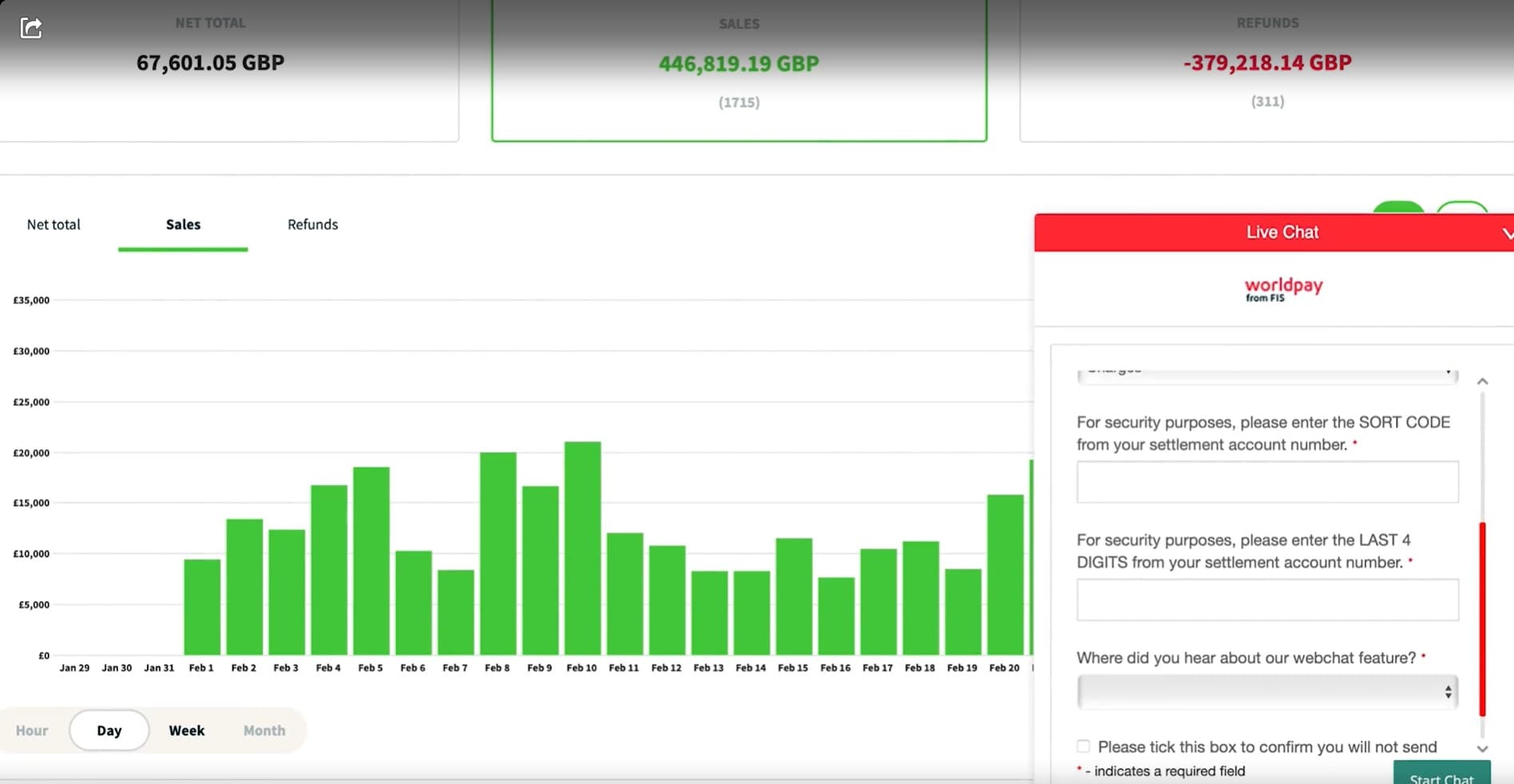

Worldpay is a global payment processor that offers a wide range of payment methods, including credit and debit cards, e-wallets, and bank transfers.

Worldpay is particularly well-suited for large businesses and enterprises, as it offers a variety of features for managing global payments.

Worldpay is particularly well-suited for large businesses and enterprises, as it offers a variety of features for managing global payments.

Payoneer

Payoneer is a payment processor that specializes in international payments. It is a good option for businesses that need to pay freelancers and contractors around the world.

Payoneer also offers a variety of other features, such as mass payouts and currency conversion.

Payoneer also offers a variety of other features, such as mass payouts and currency conversion.

Conclusion: Stripe competitors

Stripe is a globally popular payment processor, but it is crucial to compare different payment processors that are available to you before choosing which to use. Consider the features and pricing that each Stripe competitor offers, as well as the payment methods that you need to accept. You should also read reviews of different payment processors and get feedback from other businesses.

Some of the main competitors to Stripe include Adyen, Worldpay, Braintree, and 2Checkout. These payment processors offer a variety of advantages, such as more payment methods, lower fees, and more features. However, they also have some disadvantages, such as less global reach, more complex setup, and less support.

The best payment processor for your business will depend on a number of factors, such as the type of business you have, the countries you operate in, and the payment methods you need to accept. We hope you found this guide useful!

Subscribe for updates

Stay up to date on Memberful's latest product updates, insights, and teaching centered around growing your community.

Have an audience?

Customers like Mythical (28+ million subscribers) rely on Memberful to power their membership communities.

Get started for free