Metrics

Navigate to Analytics → Metrics to view the metrics we track for your business. This doc will help you understand how we calculate those metrics.

In this help doc:

- Dashboard timezone

- Live metrics vs. pre-calculated metrics

- How we calculate subscriber churn rate

- How we calculate lifetime value

- How we calculate monthly recurring revenue

Dashboard timezone

All dates and times in the dashboard are in Coordinated Universal Time (UTC), and we process all charges in UTC. Each day, the dashboard resets at 0:00 UTC (or 5pm PST / 8pm EST), meaning all live metrics will temporarily display as 0 while we refresh them for the new day.

Live metrics vs. pre-calculated metrics

Some metrics are live, while others are updated once a day:

- Live metrics: Revenue, New Orders, Renewals, Refunds

- Pre-calculated metrics: Monthly recurring revenue, Member lifetime value, MRR per member, Member churn rate

Keep in mind that the metrics displayed are before Memberful and Stripe fee deductions.

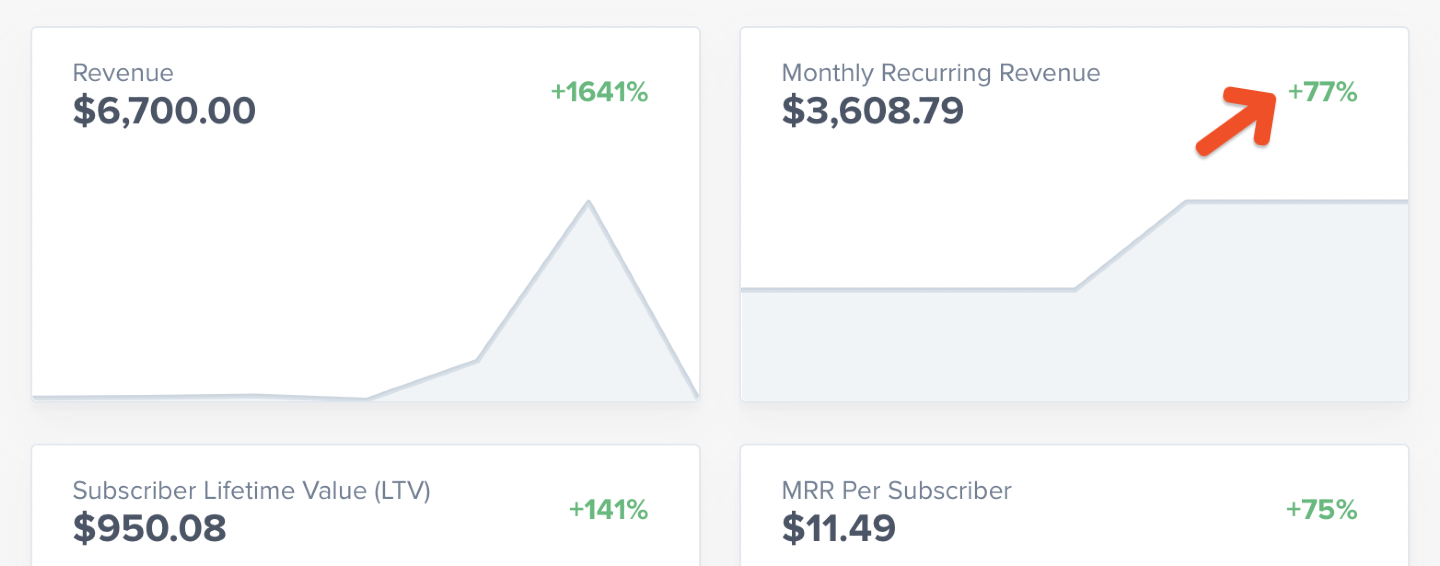

The green and red percentages represent changes between the current period and the previous period. This number can be pretty big if your site is only a little more than a year old.

How we calculate subscriber churn rate

Churn is the measure of lost members over a period of time due to passive (failed payment) or proactive (turned auto-renew off and subscription expired) events. A high churn will impact your growth.

To calculate your member churn rate, we divide paying members on recurring plans lost in the last 30 days by paying members on recurring plans 30 days ago, then multiply that number by 100.

Here’s an example:

5 / 1000 x 100 = 5% subscriber churn rate

With Memberful, we consider the following events to be a paying member loss:

- 100% coupon assigned to a subscription

- Subscription deactivation

- Subscription deletion

- Downgrades

- Delinquency lasting more than 30 days*

- Member deletion

With Memberful, the following scenarios are excluded from our churn calculations:

- Members who make a one-time payment or a fixed number of payments

- For plans that renew annually, we don't start calculating churn until 1 year passes

- Members who signed up with a 100% coupon and expired without ever paying for the subscription

- Delinquency lasting less than 30 days*

*A subscription is delinquent when it should have paid, but didn’t. That means there was an error charging their card (insufficient funds, expired, blocked, etc.) or they removed their card. In this scenario, we give them 30 days to fix the issue before counting them as a churn.

How we calculate lifetime value

Lifetime value (LTV) is the average revenue a member generates before cancelling. It’s useful to know the average LTV so that you know how much you can spend to acquire new members.

We calculate LTV by dividing average monthly recurring revenue per member by member churn rate.

Here’s an example:

$10 / .05 = $200

How we calculate monthly recurring revenue

Monthly recurring revenue (MRR) is your monthly revenue from member payments. To find MRR, we multiply the number of customers by the average billed amount. We calculate MRR for each recurring plan for the whole site and normalize this metric for non-monthly plans (e.g. if you have an annual plan which costs $120 a year we add $10 to MRR).

Here’s an example:

1000 x $10 = $10,000

Subscriptions on a free trial are not included. ❌

Members with auto-renew are included in the calculations as are any discounts from recurring coupons and inactive subscriptions that have not yet churned. (Inactive subscriptions will only be considered as churned if they do not renew 30 days after their subscriptions expires.) ✅

How we calculate MRR per subscriber

To find MRR per subscriber, we divide MRR by paying subscribers.

Here’s an example:

$10,000 / 995 = $10.05

We only use recurring plans when calculating this metric which means if a member has a 100% recurring coupon or is on a free trial, they would be excluded. If someone has three subscriptions (regardless of the plan), we don’t add three to the paying subscribers total; they count for one.

Want to learn more about using these metrics to grow your membership site? Check out this blog post.