Stripe competitors: Finding the best payment processor for you

Stripe is a payment processing platform that allows global businesses of all sizes to accept payments online (and in person). But we're aware there are several strong competitors in the market and so Stripe may not be the best payment processor for your business. That will depend on a number of factors, such as the type of business you have, the countries you operate in, the payment methods you need to accept and the features and pricing offered by each platform.

We're here to help you compare some popular Stripe competitors to see which is most relevant for you and your business!

Why is Stripe popular?

For some quick context, let's look at why Stripe is one of the most well-known payment processors in the world. Its security, accessibility and portability make it a popular choice for business owners. For example, here at Memberful, we use Stripe to process the financial transactions involved in your membership businesses.

Stripe accepts payment methods from over 135 countries and in over 135 currencies. These methods includes major credit cards, digital wallets such as Apple Pay and Google Pay, and online ACH (Automated Clearing House) payments. Stripe is a PCI DSS Level 1 service provider, and it uses the latest technologies to protect businesses and their customers.

Stripe offers a transparent pricing model that applies to all types of payments. Here is a table that summarizes Stripe's pricing model:

- U.S. card payments: 2.9% + 30¢

- International card payments: 3.9% + 30¢

- ACH payments: 1% (minimum $0.30)

- Wire transfers: 0.15% (minimum $15)

In addition to transaction fees, Stripe also charges a small fee for certain features, such as Radar for fraud protection and Billing for managing recurring payments. However, these fees are typically waived for businesses that process a high volume of payments.

Competitors to Stripe

Below are a few popular Stripe competitors but please note there may be something more relevant to your and your work. To make sure you have the best payment service for your business, it’s helpful to ask friends and colleagues for feedback, or to read reviews from other businesses.

1. PayPal

PayPal enables businesses to accept payments through credit cards, debit cards, PayPal accounts, and even PayPal Credit. It integrates with most major e-commerce platforms such as Shopify and WooCommerce. Merchants can offer fast and secure checkout options to their customers, including recurring billing and one-touch payments.

With PayPal’s global reach and multi-currency support, it’s ideal for cross-border sales. Its strong security infrastructure includes fraud detection, buyer and seller protection, and dispute resolution features.

Best suited for

PayPal is best suited for e-commerce stores, freelancers, and international sellers looking for a widely recognized and trusted payment solution.

For more information, see our in-depth review of Stripe vs Paypal.

2. Square

Square provides an all-in-one payment solution with built-in point-of-sale (POS) software that is especially useful for in-person transactions. It supports contactless payments, inventory management, employee tracking, and sales analytics.

Businesses can send invoices, process payments online or in-person, and access business loans through Square Capital. The platform also includes a virtual terminal for manual payments and integrates with accounting software for easy bookkeeping.

Best suited for

Square is best suited for small to medium-sized brick-and-mortar businesses, including retail stores, cafes, and service providers needing flexible payment tools.

3. Authorize.net

Authorize.net delivers a robust and secure payment gateway for businesses that need custom payment solutions and enterprise-grade protection. It supports credit card processing, eChecks, recurring billing, and international transactions.

The platform features a customer information manager for secure storage, as well as hosted payment forms to ensure PCI compliance. Its advanced fraud detection tools allow merchants to manage risk effectively, while its compatibility with multiple banks and processors offers flexibility.

Best suited for

Authorize.net is best suited for established businesses and enterprises that require reliable, secure, and customizable payment infrastructure.

4. Braintree

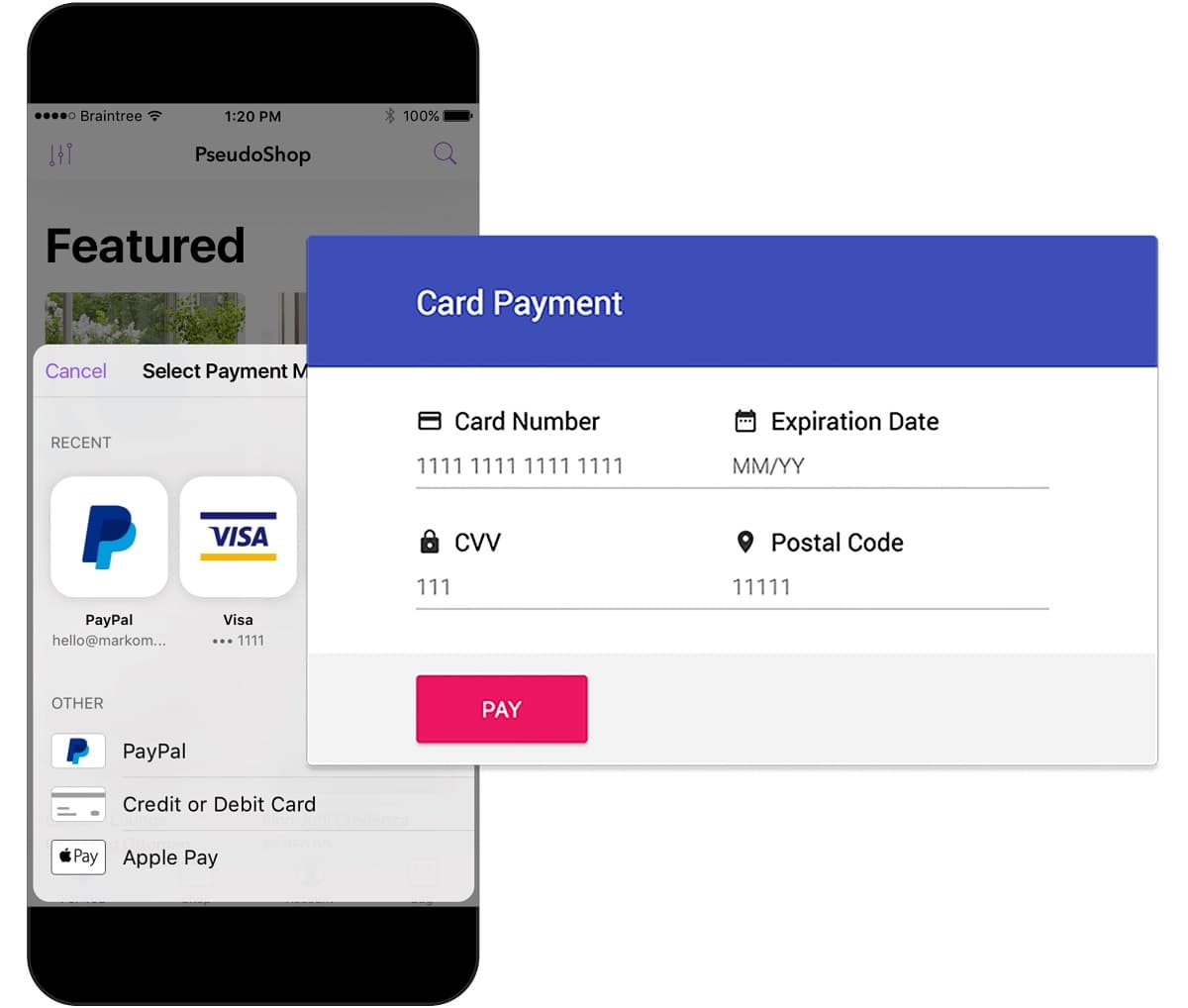

Braintree offers a full-stack payment solution with advanced APIs tailored to developers and mobile-first businesses. It supports a wide variety of payment methods including PayPal, Venmo, Apple Pay, Google Pay, and all major cards.

Its seamless mobile checkout experience, subscription billing, and fraud tools make it ideal for tech-savvy operations. Additionally, Braintree’s global reach allows merchants to accept payments in over 130 currencies across more than 45 countries.

Best suited for

Braintree is best suited for mobile apps, SaaS platforms, and startups that prioritize user experience and flexible developer tools.

5. Adyen

Adyen provides a unified commerce platform that handles online, mobile, and in-person payments globally. It supports over 250 payment methods and more than 150 currencies, allowing businesses to expand internationally with ease.

With features like real-time transaction monitoring, fraud prevention powered by AI, and customizable checkout flows, Adyen delivers performance and scalability. Its API is well-documented and designed to handle large transaction volumes for enterprises.

Best suited for

Adyen is best suited for multinational corporations and fast-scaling businesses with complex international payment needs.

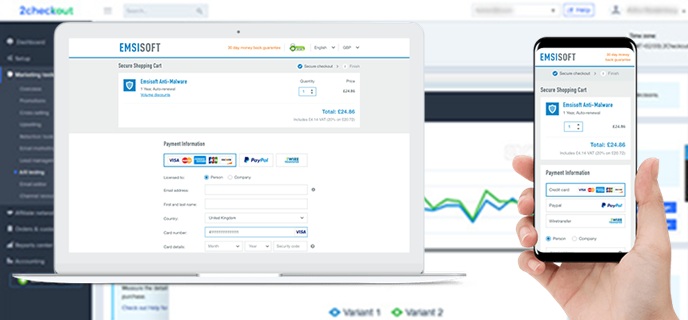

6. 2Checkout (Verifone)

2Checkout provides a monetization platform for digital businesses with an emphasis on global e-commerce and subscriptions. It offers several checkout options, recurring billing tools, affiliate management, and localization features like language and currency customization.

The platform ensures tax compliance worldwide and includes fraud prevention and chargeback mitigation services. With seamless integration into popular shopping carts, it supports end-to-end international commerce.

Best suited for

2Checkout is best suited for SaaS companies, digital product vendors, and international businesses needing a global e-commerce solution.

7. Wise (formerly TransferWise)

Wise specializes in international money transfers with real exchange rates and transparent fee structures. It offers borderless business accounts that support multiple currencies and provide localized account details such as IBANs and routing numbers.

Wise is also integrated with accounting tools like Xero and QuickBooks, and it supports batch payments and API access for businesses with large payment volumes. It is regulated across multiple financial jurisdictions and prioritizes speed, accuracy, and low cost.

Best suited for

Wise is best suited for freelancers, remote teams, and companies making frequent international payments that prioritize transparency and savings.

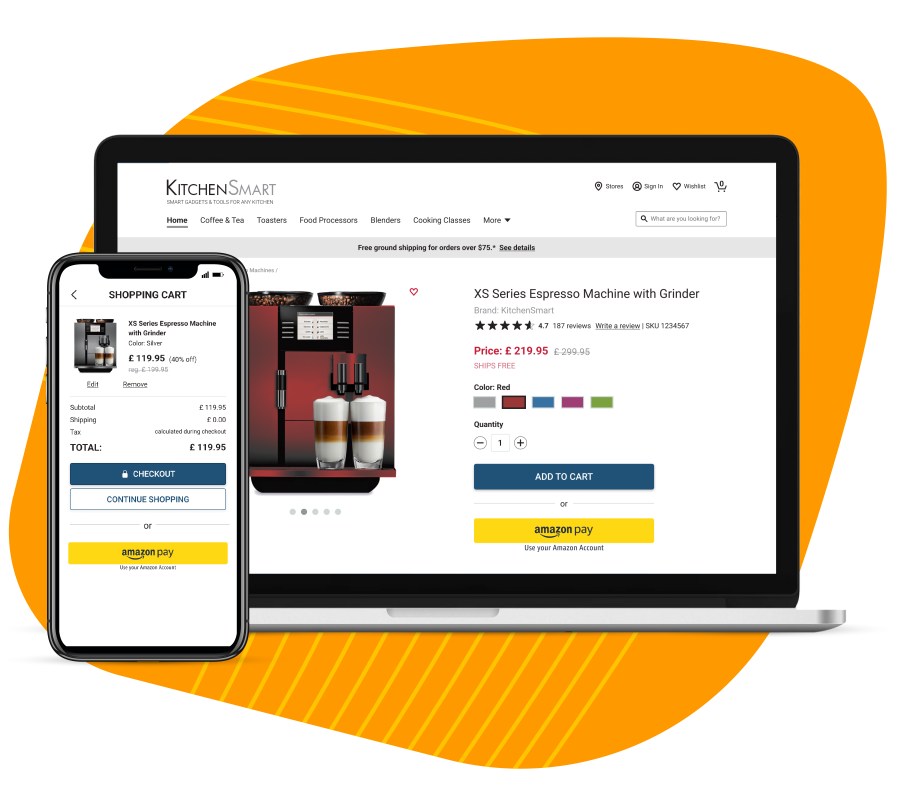

8. Amazon Pay

Amazon Pay allows customers to complete transactions using the payment information stored in their Amazon accounts. It offers a streamlined, one-click checkout process that helps improve conversion rates by eliminating unnecessary steps. Businesses can easily integrate it into their existing websites, especially if they use platforms like Shopify or Magento.

The service includes voice payment support through Alexa-enabled devices and supports recurring billing for subscription-based services. With built-in fraud detection and a familiar interface, Amazon Pay leverages Amazon’s infrastructure to deliver secure and efficient payment processing.

Best suited for

Amazon Pay is best suited for online retailers targeting customers who already have Amazon accounts. It’s particularly effective for businesses looking to reduce cart abandonment and create a seamless checkout experience.

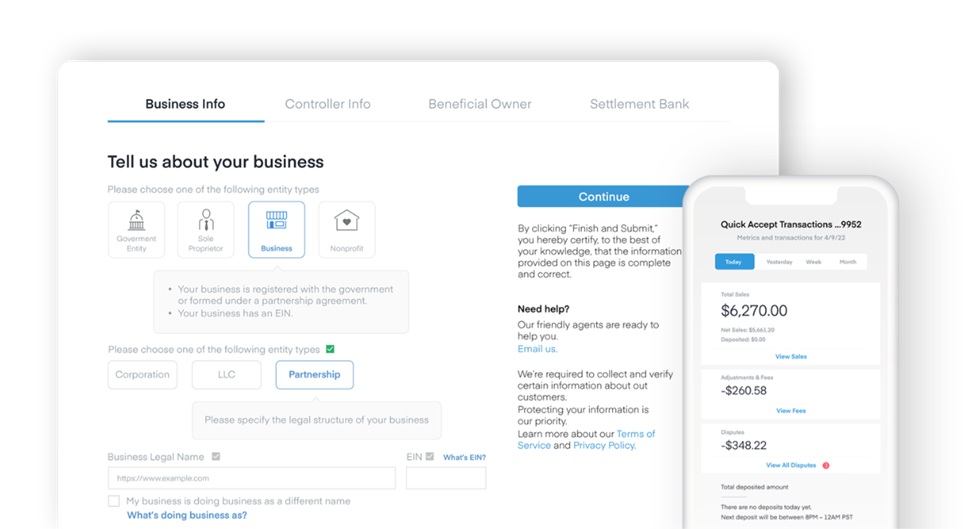

9. WePay

WePay offers a payment infrastructure tailored to platforms, marketplaces, and crowdfunding sites. It enables businesses to embed white-label payment solutions directly into their products, providing a fully branded experience. Backed by JPMorgan Chase, WePay offers seamless banking integrations and fast onboarding processes.

The platform includes tools for fraud management, compliance, and direct payouts. Its developer-friendly APIs allow customization and scalability, making it suitable for platforms that require integrated financial services.

Best suited for

WePay is best suited for crowdfunding platforms, SaaS companies, and marketplaces that need a flexible, white-label solution with banking integrations and a scalable infrastructure.

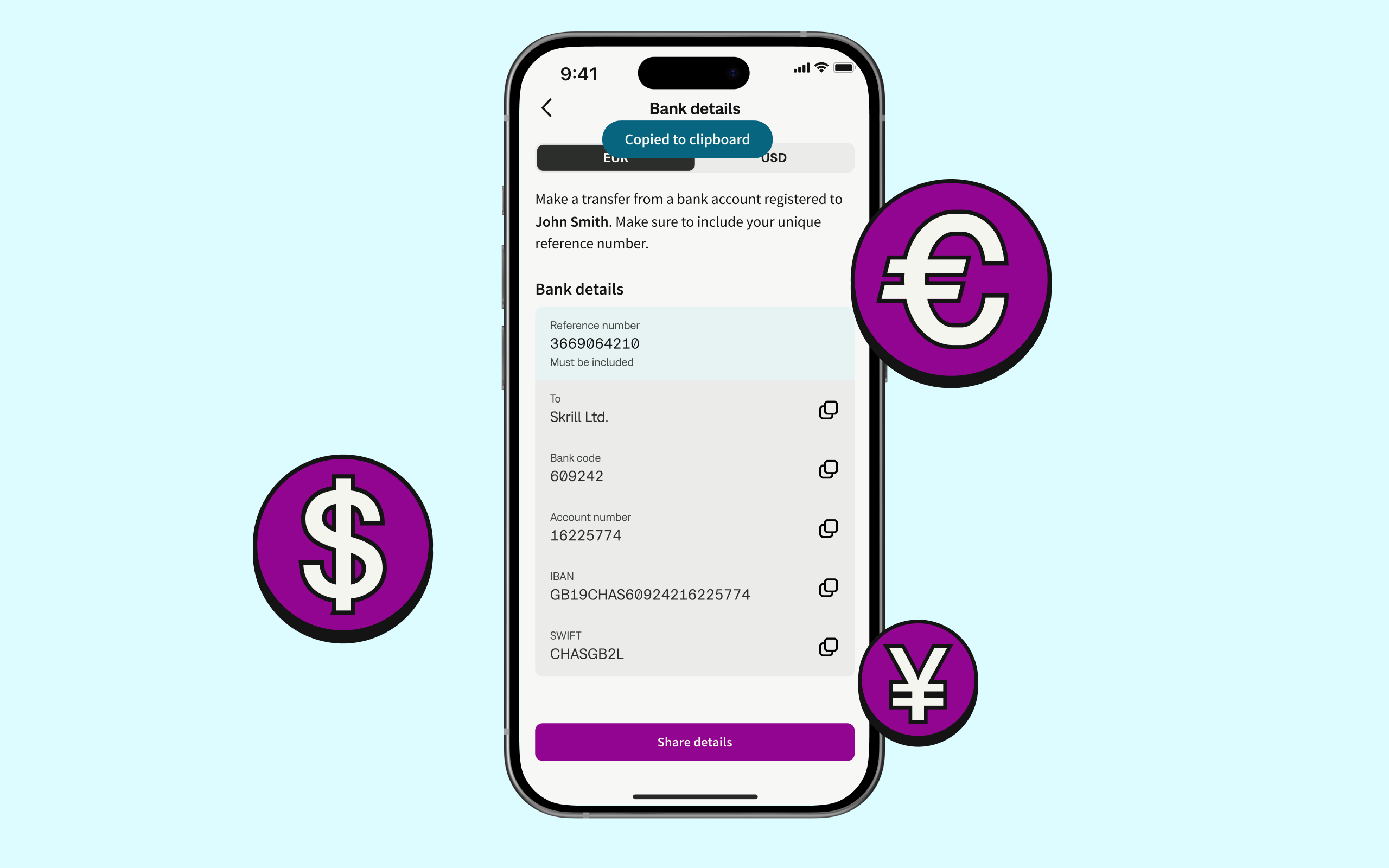

10. Skrill

Skrill is a digital wallet and international payment service known for its low-cost, fast transactions. It supports instant money transfers, including crypto trading, and enables users to send and receive money in multiple currencies. Businesses can integrate Skrill through plugins or APIs to accept payments globally.

A prepaid Mastercard linked to Skrill accounts provides added convenience. Security is enhanced through two-factor authentication and fraud protection tools. Skrill’s quick setup process and wide international reach make it an attractive option for digital-first businesses.

Best suited for

Skrill is best suited for businesses involved in gaming, forex trading, and international e-commerce. It’s an excellent choice for those looking for cost-effective, fast global transactions and support for cryptocurrency.

Frequently asked questions (FAQs) for Stripe alternatives

Which Stripe alternative is best for international transactions?

Wise, Adyen, and 2Checkout stand out for international businesses. Wise is particularly cost-effective for cross-border money transfers, while Adyen supports over 250 local payment methods and currencies.

What’s the most cost-effective Stripe alternative?

Skrill and Wise often offer the lowest transaction fees, especially for international payments. However, Square offers low fees for in-person transactions, making it ideal for small local businesses.

Can I use more than one payment processor?

Yes. Many businesses implement multiple processors (e.g., PayPal + Square) to give customers flexibility and to mitigate processing risks. This also improves conversion rates by catering to various customer preferences.

Which alternative supports recurring billing?

Most options like PayPal, Authorize.net, Braintree, Adyen, 2Checkout, Amazon Pay, WePay, and Skrill support subscription-based billing. Wise does not offer this feature.

What Stripe alternatives are best for mobile apps?

Braintree and Adyen provide the best developer tools for integrating payments into mobile applications, offering responsive APIs and seamless in-app payment flows.

Are there any free payment processors?

While none of the providers are truly free, platforms like Square and PayPal do not charge monthly fees. They make their revenue from per-transaction costs.

Conclusion: Best Stripe alternatives

Selecting the right Stripe alternative depends entirely on your specific business requirements. For those looking for global reach and extensive payment options, Adyen and 2Checkout are top-tier choices. If you're a freelancer or small business, Square, PayPal, and Braintree provide affordability and simplicity.

For international remittances or cross-border payments, Wise and Skrill shine with their low fees and multi-currency capabilities. Meanwhile, platforms such as WePay cater exceptionally well to niche models like crowdfunding and marketplaces, while Amazon Pay enhances trust and conversion with Amazon’s vast user base.

Before deciding, consider the regions you operate in, the types of customers you serve, and your growth ambitions. The best payment processor for your business will depend on a number of factors, such as the type of business you have, the countries you operate in, and the payment methods you need to accept. We hope you found this guide useful!

Subscribe for updates

Stay up to date on Memberful's latest product updates, insights, and teaching centered around growing your community.

Have an audience?

Customers like Mythical (28+ million subscribers) rely on Memberful to power their membership communities.

Get started for free